Credit Cards

Apply for the Navy Federal GO REWARDS®: earn up to 3 points

Are you a Navy Federal member and want to know how to apply for the Navy Federal GO REWARDS®? Here is the guide you are looking for.

Advertisement

Find out the easiest way to apply for Navy Federal credit cards!

Are you interested in a rewarding credit card for everyday spending? Then apply online for the Navy Federal GO REWARDS®.

Earn points on restaurants, gas, and all purchases. Find out more about the application process and who is eligible for this credit card. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The Navy Federal GO REWARDS® is a good credit card for daily spending. However, not everyone can apply for one.

Here is who is part of the group: Active duty, retired, veterans.

Also, DoD civilian personnel, along with their immediate family members or household, including parents, grandparents, or guardians of minors, are eligible.

So, if you’re interested in getting a Navy Federal GO REWARDS®, you have three different ways to apply, depending on your preferences.

Online

To apply for the card, the quickest and most convenient method is an online application.

This secure and speedy process involves visiting the card’s website, hitting “Apply Now,” logging into your account and following the provided steps.

Advertisement

Over the phone

If you prefer to talk to someone, you can then apply over the phone by calling (888) 842-6328.

A representative will be available to answer any questions you may have and guide you through the process.

In-person

Lastly, you can apply in person by visiting one of the Navy Federal branches near you.

Advertisement

Apply using the app

Applying for this credit card using the Navy Federal app is impossible, so make sure to use one of the methods above.

Navy Federal GO REWARDS® vs. Navy Federal Visa Signature® Flagship Rewards

These Navy Federal cards fit different needs:

- Navy Federal GO REWARDS®: good for daily expenses with points on restaurants and gas.

- Navy Federal Visa Signature® Flagship Rewards: travel card with lounge access, as well as travel points.

Choose the best one for your finances below.

Navy Federal GO REWARDS®

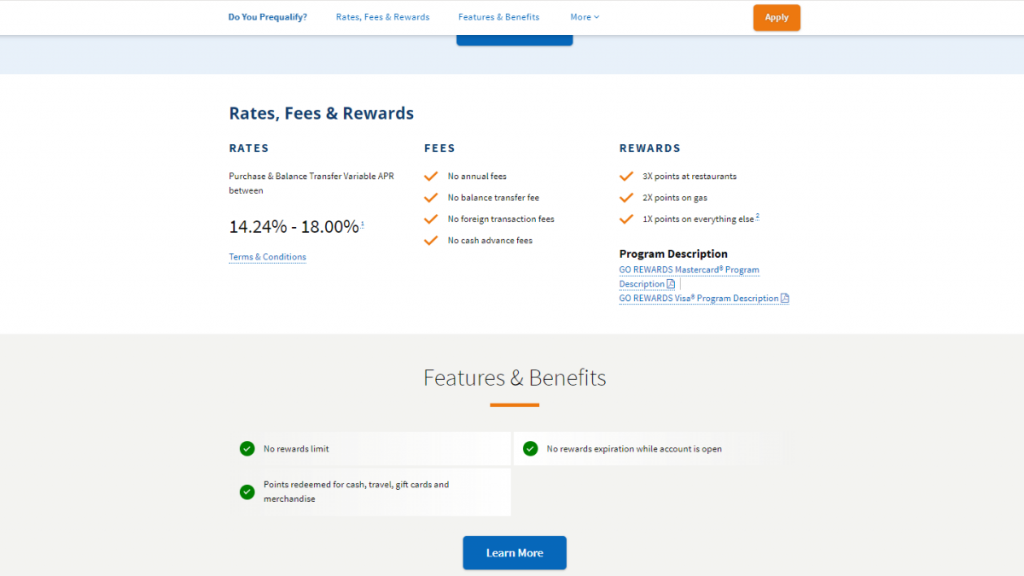

- Credit Score: Average-Excellent;

- Annual Fee: $0;

- Purchase APR: 14.24% to 18.00% (Variable);

- Cash Advance APR: 2% above the purchase APR;

- Welcome Bonus: Earn 15k bonus points after spending $1,000 within 90 days of account opening;

- Rewards: 3 points at restaurants, 2 points on gas, 1 point on everything else.

Navy Federal Visa Signature® Flagship Rewards

- Credit Score: Good-Excellent;

- Annual Fee: $0 annual fee for the first year, then $49;

- Purchase APR: 15.24% to 18.00% (Variable);

- Cash Advance APR: 2% above the purchase APR;

- Welcome Bonus: Earn 30,000 bonus points after spending $3,000 within 90 days of account opening and a free year of Amazon Prime;

- Rewards: 3 points on travel, 2 points on everything else, and statement credits for Global Entry or TSA Pre✓® ( up to $100).

Want to apply for the Navy Federal Visa Signature® Flagship Rewards? Stay tuned to our upcoming post.

Apply for the Navy Federal Flagship Rewards

Apply for the Navy Federal Visa Signature® Flagship Rewards today – earn up to 3X points on purchases + amazing benefits! Keep reading!

Trending Topics

Learn all the main pros of rewards credit cards

Do you know the pros of credit card rewards? You can take advantage of your credit cards and get a lot of benefits. Learn how to do it.

Keep Reading

Chase Secure Banking℠ application: how does it work?

Discover how to make the Chase Secure Banking℠ application – a convenient way to manage your finances better. No minimum deposit.

Keep Reading

What is a money market account and how to open one?

Learn what a money market account is and how it can help you save money while earning interest. Keep reading!

Keep ReadingYou may also like

Luxury Black or Luxury Gold card: choose the best!

Are you thinking about getting a Luxury Black or Luxury Gold card? First, read this article to learn about their benefits to choose the best.

Keep Reading

No annual fee: Apply for U.S. Bank Visa® Platinum Card

Get the step-by-step process to apply for the U.S. Bank Visa® Platinum Card! Instant decision! Enjoy an intro APR!

Keep Reading

The easiest way to improve your credit score: a quick guide

Do you know how to improve your credit score? Follow these 5 simple steps and get on the path to a better credit history!

Keep Reading