Loans

Apply through MaxCarLoan: Skip the Dealership

Learn how to apply for a loan through MaxCarLoan. The broker connects you with top lenders for the best car loan rates and terms: fast approval, no hassle.

Advertisement

Need the perfect car loan without the paperwork headache? MaxCarLoan finds you the best rates and terms!

Dreaming of a new car? Then, you want to know how to apply through MaxCarLoan, the marketplace, to make it a reality.

They connect you with a vast network of lenders, uncovering the most budget-friendly options for your perfect car. So, read on to learn the application process!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

With MaxCarLoan, you can find funding options to buy a car that fits your budget in just a few minutes.

So, if you want to use MaxCarLoan to apply for an auto loan, follow the guide below.

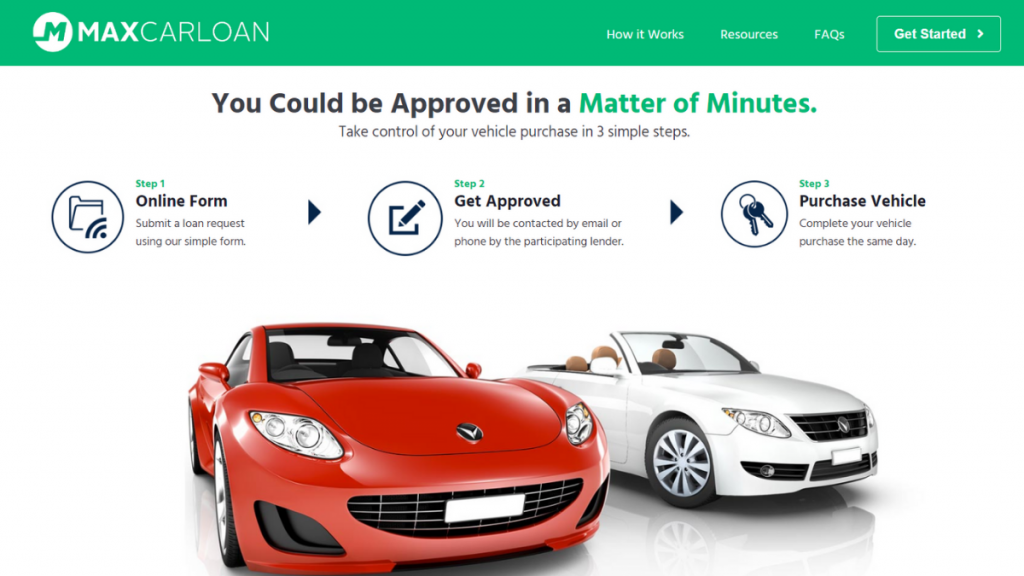

Step 01- Submit an Online Form

To get a car loan, the first step is to go to the MaxCarLoan website. Once you’re there, you’ll fill out a form to request a loan.

It’s really easy and only takes about 5 minutes. Still, you can do it anywhere using your computer, tablet, or smartphone.

Advertisement

Step 02- Finding a Perfect Lender

After submitting your application, then a lender will get in touch with you through email or phone.

Then, you’ll receive an offer, and if you feel like proceeding, just accept it.

However, if you don’t, it’s okay, there is no obligation.

Step 03- Buying your Vehicle

Once you’ve sealed the deal, you can buy your car on the same day.

Then, just take your pre-approval to the dealership, choose your car, and complete the transaction.

Advertisement

Requirements

Their website does not display the requirements to get a loan through MaxCarloan.

However, most loan brokers consider some aspects before approving a loan application, such as:

- Credit score;

- Income;

- Employment history;

- Debt-to-income ratio.

So, when getting a loan, it’s important to understand these factors and how they can affect your loan eligibility and interest rates.

Apply using the app

If you’re looking to apply for a car loan with MaxCarLoan, you won’t be able to do so through an app on your phone.

Instead, you must visit their website to complete the application process.

MaxCarLoan vs. CarLoans.com

MaxCarLoan focuses only on auto loans and offers a quicker pre-approval process. So, it is great for people who want a simple and fast experience.

The second option is CarLoans.com, which offers more loan choices and might also have some direct lending opportunities.

Overall, the approval times and terms may vary depending on the lender you choose for both lenders.

So, the best choice for you is the one that suits your needs. Have a look at the comparison below.

MaxCarLoan

- APR: N/A;

- Loan Purpose: Car loan;

- Loan Amounts: Depends on the lender;

- Credit Needed: All credit types are considered;

- Origination Fee: Not applied;

- Late Fee: Not applied;

- Early Payoff Penalty: Not applied.

CarLoans.com

- APR: From 3.2% to 24% ( depending on your creditworthiness);

- Loan Purpose: Auto loans;

- Loan Amounts: N/A;

- Credit Needed: No minimum credit score is required;

- Origination Fee: Depends on the lender;

- Late Fee: Depends on the lender;

- Early Payoff Penalty: Depends on the lender.

Learn how to apply for a personal loan with CarLoans.com easily in our post below!

Learn to apply easily for CarLoans.com

Have you been thinking of buying a new car? Then learn how to apply for CarLoans.com! Get approved in 2 minutes! Keep reading!

Trending Topics

Auto Credit Express review: how does it work and is it good?

Find out how to get an auto loan with specialists in bad credit. Read on to an Auto Credit Express review and learn more.

Keep Reading

Learn how to download the Calm App and manage your anxiety and stress

Learn how to download the Calm App to manage your anxiety and stress healthily. So, stay tuned and keep reading to start!

Keep Reading

Renting or buying a home: find out what is best for you!

Unsure about renting or buying a home? Check out this post to help make the decision easier. Read on to learn more!

Keep ReadingYou may also like

Learn to apply easily for Auto Credit Express

Discover how to apply for a loan with Auto Credit Express online and quickly. Keep reading to find out more!

Keep Reading

CarLoans.com review: how does it work and is it good?

Do you want to get a car loan, regardless of your bad credit score? Read this CarLoans.com review, and find out more! Fast approval!

Keep Reading

The best credit cards in the US for 2022

Learn today what are the best credit cards in the US and start earning rewards and enjoying many benefits and perks in 2022!

Keep Reading