Credit Cards

Apply for Delta SkyMiles® Blue American Express Card easily

Get the latest guide to apply for the Delta SkyMiles® Blue American Express Card and make your travels more rewarding. Keep reading to master the process!

Advertisement

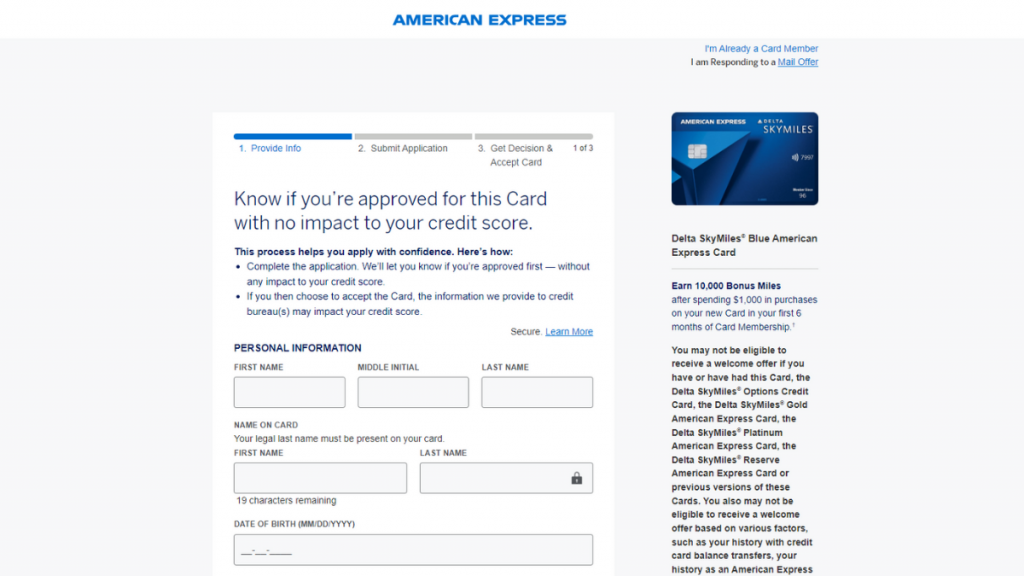

Know if you are approved without hurting your score

Ready to rack up Delta miles without an annual fee? Apply for the Delta SkyMiles® Blue American Express Card today with our guide.

Earn 10,000 bonus miles and also double miles on dining and Delta purchases. Read to find out how to apply now!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The Delta SkyMiles® Blue American Express Card is a great travel card that doesn’t charge any yearly fees and gives you 1 mile for every dollar you spend.

So, if you want to apply for the Delta SkyMiles® Blue American Express Card, here’s what you need to do:

- Visit the American Express website and look for the application process.

- Then, enter your personal information, such as your name, address, date of birth, and Social Security number.

- Also, provide your financial information, such as your income and expenses.

- Once you’re done, submit your application for review.

Finally, you just need to wait a little to receive a decision on your application. This process takes seconds.

So, if you get a positive response, your card will arrive in the mail in about 7-10 business days.

Apply using the app

To get an Amex credit card, go to their website to apply. Unfortunately, you can’t apply for their cards through their mobile app.

Advertisement

Delta SkyMiles® Blue American Express Card vs. Bank of America® Travel Rewards

When choosing a credit card for travel rewards, the Delta SkyMiles® Blue American Express Card and the Bank of America® Travel Rewards credit card are two popular options.

On the one hand, The Delta SkyMiles® Blue American Express Card offers miles for Delta flights and other purchases.

On the other hand, the Bank of America® Travel Rewards credit card offers points that can be redeemed for travel expenses.

Ultimately, the best choice depends on your needs and travel preferences.

Delta SkyMiles® Blue American Express Card

- Credit Score: Good – Excellent;

- Annual Fee: No annual fee;

- Purchase APR: 20.99% to 29.99% variable;

- Cash Advance APR: 29.99% variable;

- Welcome Bonus: Earn 10K bonus miles after spending $1,000 in purchases during the first 6 months of card membership;

- Rewards: 2x miles on dining, 2x miles on Delta purchases, and 1x mile on all other purchases.

- See Rates & Fees

Advertisement

Bank of America® Travel Rewards

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Purchase APR: 0% intro APR for the first 18 billing cycles ( then 18.24% to 28.24% variable APR), and any balance transfers made during the first 60 days of account opening (then a 3% fee applies);

- Welcome Bonus: 25K online bonus points after you make more than $1.000 on purchases during the first 90 days of account opening;

- Rewards: Earn 1.5 points on all purchases.

Have you decided to apply for the Bank of America® Travel Rewards card? Stay tuned to learn more about the process!

Apply for Bank of America® Travel Rewards

Apply for the Bank of America® Travel Rewards credit card and earn points on travel purchases. Follow our step-by-step guide!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Apply for the Verizon Visa® Card: enjoy no annual fee

You can apply for a Verizon Visa® Card easily! Earn up to 4% cash back with no annual fee! Read on and learn more!

Keep Reading

Choose the right checking account for you

A checking account is necessary for your financial life. Learn about the different types of checking accounts and find the best one.

Keep Reading

Apply for Navy Federal cashRewards Credit Card: $0 annual fee

How to apply for the Navy Federal cashRewards Credit Card - everything you need! Earn cash back on purchases! Read on!

Keep ReadingYou may also like

Discover it Student Chrome credit card review: is it worth it?

The Discover it Student Chrome credit card offers solid rewards for students, and a great welcome bonus to earn double cashback.

Keep Reading

How to apply and get verified on the Buy On Trust Lending easily

No credit? No problem. Learn how to apply for a Buy On Trust account, get the brand name products you love, and pay for them over time.

Keep Reading

Milestone® Mastercard® – Less Than Perfect Credit Considered review

This credit card is a good option to rebuild your score. Check out the Milestone® Mastercard® - Less Than Perfect Credit Considered review!

Keep Reading