Loans

Apply for CreditFresh: It’s Fast and Easy

CreditFresh has a line of credit for those who want to improve their score and start a healthier financial path. Here, you'll discover how to apply for CreditFresh online. Keep reading!

Advertisement

Boost your credit score and gain financial flexibility with a credit line

CreditFresh offers a line of credit to those who want to improve their credit score and also take a step towards a more financially secure future. Interested applicants can easily apply for CreditFresh online.

The application process is simple. So, if you want to learn how to apply for their line of credit, keep reading!

Online application

If you want to find a new way to revamp your credit score, you should consider CreditFresh, a line of credit of up to $5,000.

They offer an online application that is quick and effective. If interested, then here is how to apply for a CreditFresh line of credit in minutes.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

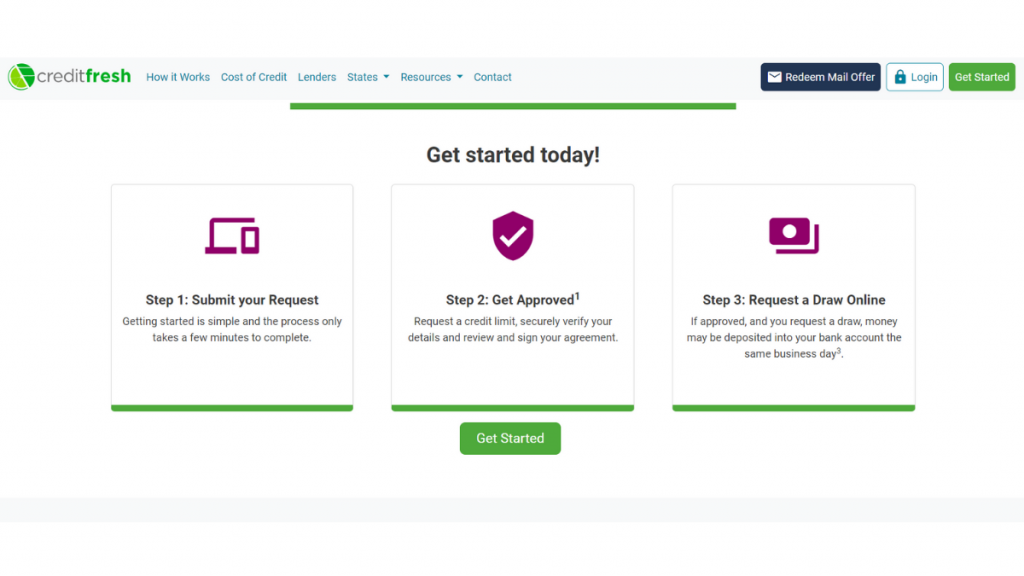

1. Submit your Application Request

To get started, go to the CreditFresh website and then complete your application.

You’ll also need to provide some information about yourself and your finances.

It’s important to fill out all the required fields accurately and completely so your application can be processed smoothly.

2. Approval

The next step is to request a certain amount of money that you can borrow from CreditFresh and then confirm that it’s really you by answering some security questions.

Finally, you will have to read and sign a document that explains all the terms and conditions of the loan.

3. Drawline

If your request is approved and you ask for a payout, then you may receive the money in your bank account on the same business day.

Requirements

If you want to get a line of credit through CreditFresh, then here are some requirements.

- Have age majority in your state;

- Be a permanent resident or US citizen;

- Have an active bank account;

- Have proof of income;

- Have a valid contact number and email address.

Apply using the app

It’s impossible to apply for a credit line through the CreditFresh app. Visit the website instead.

CreditFresh vs. MoneyLion Loans

If you’re looking for ways to boost your credit score, then CreditFresh, and MoneyLion Loans can help you out.

CreditFresh has a line of credit that goes up to $5,000, while MoneyLion Loans offers a credit builder loan of up to $1,000.

Below, you can compare these two options so that you can decide what works best for you and your financial goals.

CreditFresh

- APR: 65%- 200%;

- Loan Purpose: Any purpose;

- Loan Amounts: $500-$5,000;

- Credit Needed: None;

- Origination Fee: None;

- Late Fee: None;

- Early Payoff Penalty: None.

MoneyLion Loans

- APR: 5.99% to 29.99%;

- Loan Purpose: Credit-builder;

- Loan Amounts: Up to $1,000;

- Credit Needed: All credit types are considered;

- Origination Fee: N/A;

- Late Fee: N/A;

- Early Payoff Penalty: N/A.

If you want to boost your score with a credit builder loan from MoneyLion Loans, then keep reading to get a full application guide.

Apply for MoneyLion Loans: Easy Credit Builder

Stuck in credit limbo? Keep reading to learn how to apply for MoneyLion Loans to the rescue! NO hard inquiry!

Trending Topics

Walmart MoneyCard® application: how does it work?

Learn how the Walmart MoneyCard® application process works and how you can earn cash back on all of your Walmart purchases!

Keep Reading

Red Arrow Loans review: how does it work and is it good?

Read our Read Arrow Loans review to learn more about this company and compare it to others in the market. Check it out!

Keep Reading

Blue Sky Financial Mortgage review: how does it work and is it good?

Our Blue Sky Financial Mortgage review uncovers its main features! Connect several lenders through this simple mortgage marketplace! Read on!

Keep ReadingYou may also like

Navy Federal cashRewards Credit Card Review: $250 bonus cash back

Review of the Navy Federal cashRewards Credit Card: perks, rewards, and who should consider this hidden gem. No hidden fees! Read on!

Keep Reading

Southwest Rapid Rewards® Plus Credit Card application: how does it work?

Apply for the Southwest Rapid Rewards® Plus Credit Card faster and easier with our tips! Read on to learn how to apply!

Keep Reading

How to build credit as a college student

Are you wondering how to build credit as a college student? It's not too hard, and this guide will show you how. Read on!

Keep Reading