Reviews

Learn to apply easily for ClearMoneyLoans.com

Learn how to quickly and easily apply for a loan with ClearMoneyLoans.com - we simplify the process for you. Read on!

Advertisement

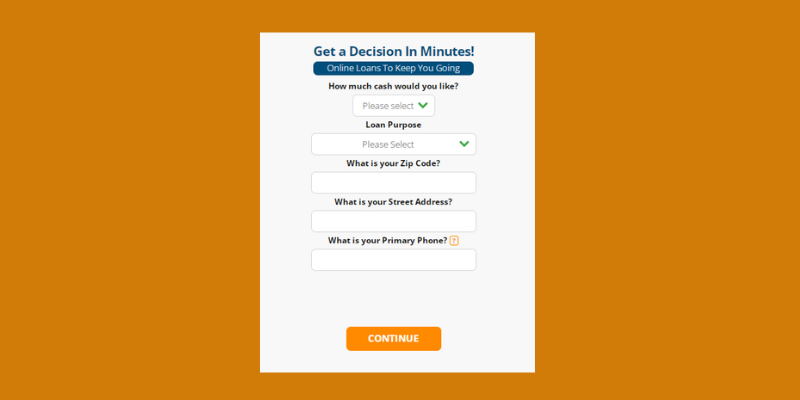

ClearMoneyLoans.com application: Reach many lenders with a single application!

There is no need to spend hours and hours filling out individual loan applications when you can reach many lenders if you apply to ClearMoneyLoans.com.

With their easy-to-use form, you can submit your request for a personal loan quickly and easily. So why wait? Understand how to make your application today. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

ClearMoneyLoan.com is an online lending platform that offers personal loans and credit lines to qualified borrowers.

The application process is straightforward, and you can get started by creating an account on the ClearMoneyLoan.com website.

Once you’ve created an account, you’ll need to provide basic information about yourself and your finances.

ClearMoneyLoan.com will then use this information to determine whether you’re eligible for a loan or credit line.

If you are, you’ll then be able to choose the loan amount and repayment terms that best suit your needs.

Once you’ve been approved for a loan, the money will be deposited into your bank account within 1-2 business days.

Requirements

ClearMoneyLoan.com is not a lender, but they find the best lenders for you.

They have some requirements in common if you are considering getting this loan.

It’s necessary to be 18 years old or older and have a checking or savings account with direct deposit to receive funds.

Still, your regular income must be at least $1,000 monthly.

Members of the military or dependents of the military are not welcome to apply.

Advertisement

Apply using the app

ClearMoneyLoans.com doesn’t provide an app yet. Potential borrowers must use their website to make the application.

ClearMoneyLoans.com vs. Bad Credit Loans: which one is the best?

ClearMoneyLoans.com and Bad Credit Loans are platforms specialized in lending to people with bad credit.

They have similar rates, terms, and requirements. However, Bad Credit Loans is a lender that offers less money than ClearMoneyLoans.com.

Review both lenders’ most important information, and find out which one you would like to apply to.

Advertisement

ClearMoneyLoans.com

- APR: variable 3.09% to 35.99% APR;

- Loan Purpose: Wedding, Medical Expenses, Debt Consolidation, auto repair, home renovations, vacations, and others;

- Loan Amounts: $1,000 and $35,000;

- Credit Needed: All credit scores are accepted;

- Origination Fee: Depends on the lender;

- Late Fee: Depends on the lender;

- Early Payoff Penalty: Depends on the lender;

Bad Credit Loans

- APR: Usually ranges from 5.99% to 35.99% (it can vary according to the lender’s requirements);

- Loan Purpose: Improve credit score;

- Loan Amounts: From $500 up to $10,000;

- Credit Needed: 500 or lower (poor credit);

- Origination Fee: Varies by the lender;

- Late Fee: Varies by the lender;

- Early Payoff Penalty: Varies by the lender.

You can find more information about Bad Credit Loans in the application guide post we prepared just for you. Check it out!

How to apply for Bad Credit Loans

Need a loan fast, but have bad credit? Don't worry! Our step-by-step guide lets you learn how to apply for a Bad Credit Loan easily. Read on!

Trending Topics

Facts about credit cards: 7 important things you didn’t know

Some facts about credit cards are unknown to many users. We recommend you to read this article with some tips to master your cards.

Keep Reading

How many mortgages can you have? Real estate investing 101

If you're considering investing in real estate, find out how mortgages work and how many you can have while taking out a loan.

Keep Reading

Learn all the main pros of rewards credit cards

Do you know the pros of credit card rewards? You can take advantage of your credit cards and get a lot of benefits. Learn how to do it.

Keep ReadingYou may also like

What is a balance transfer credit card: is it a good idea?

Do you know what is a balance transfer credit card? Read this article to see how getting one can help you get your finances on track!

Keep Reading

PenFed Credit Union Personal Loans review: how does it work and is it good?

PenFed Credit Union Personal Loans review covers how it works and its pros and cons. Check out our post to learn more!

Keep Reading

Explore the steps to apply for My GM Rewards® Mastercard®

Want to earn rewards on your GM purchases? Apply for My GM Rewards® Mastercard® now and start earning today!

Keep Reading