Reviews

Chase Sapphire Reserve® application: how does it work?

Unlock the secrets to getting Chase Sapphire Reserve® - keep reading and find out how to apply! Plus, find out the multiple perks this card offer.

Advertisement

Chase Sapphire Reserve®: A rich travel card for avid travelers!

Are you thinking of applying for the Chase Sapphire Reserve®? Don’t wait any longer! Our guide will give you all the information you need to take advantage of this card’s huge benefits.

Start your journey today and get ready to experience luxury Rewards with this card. The Chase Sapphire Reserve® allows you to earn points in multiple ways. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

First, go to the website, fill out an application form with key pieces of info (including name, address, and SSN), let them know you’re a US resident, input financials like income and assets then submit.

The response should come within minutes. Make sure you read all terms and conditions carefully before submitting.

Apply using the app

Unfortunately, the Chase Sapphire Reserve® Card application isn’t available over the app – you’ll have to apply through the website.

Still, customers can use the Chase Mobile app to manage their cards, make payments, and more.

Advertisement

Chase Sapphire Reserve® vs. HSBC Cash Rewards Mastercard®

The Chase Sapphire Reserve® and the HSBC Cash Rewards Mastercard® are excellent credit cards, but they offer different benefits.

The Chase Sapphire Reserve® has a higher annual fee. Still, it offers several valuable benefits, including a $300 annual travel credit, a 50% bonus on points earned through travel, and access to airport lounges.

The HSBC Cash Rewards Mastercard®, on the other hand, has no annual fee and offers up to 1,5% cash back on purchases.

Chase Sapphire Reserve®

- Credit Score: Excellent;

- Annual Fee: $550, or $75 for each authorized user;

- Regular APR: 21.24% – 28.74% variable APR for purchases and balance transfers; 29.49% variable APR for cash advances;

- Welcome Bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- Rewards: Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases;

- Terms apply.

Advertisement

HSBC Cash Rewards Mastercard®

- Credit Score: 760 or better;

- Annual Fee: $0;

- Regular APR: 20.99% on purchases and 22.99% on cash advances and balance transfers;

- Welcome bonus: Earn an additional 12,5% cash back on all purchases during the first 180 days ( offer up to February 2023, conditions apply). Also, in this period, you’ll earn up to 14% cash back on online purchases, 13,5% on eligible gas, grocery, and drugstore, and up to 13% on all other daily purchases;

- Rewards: Earn 1,5% cash back on eligible online purchases, 1% cash back on eligible gas, grocery, and drugstore, and 0.5% on all other purchases.

Are you interested in applying for the HSBC Cash Rewards Mastercard®? We have a guide post that can get you started. Check it out below!

How do you get the HSBC Cash Rewards Mastercard®?

We love a good cashback. Even better if it comes with no annual fees. That's the case with the HSBC Cash Rewards Mastercard® card, so take a look on how to apply for it.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Learn to apply easily for the Prosper Personal Loan

Find out how to apply for the Prosper Personal Loan and quickly get the money you need. Read on to learn more!

Keep Reading

Application for the Freedom Gold card: how does it work?

Get your Freedom Gold card to buy everything you need from the Horizon Outlet. The application is easy and you can make it right now.

Keep Reading

Learn to apply easily for the Avant Personal Loan

Do you want to apply for the Avant Loan? It's fast, easy, and secure. Stay here to learn more about this loan.

Keep ReadingYou may also like

Flagstar Bank Mortgage review: how does it work and is it good?

This Flagstar Bank Mortgage review will uncover all this lender's details! Options with 0% to 3% minimum down payment and affordable loans.

Keep Reading

The most common myths about your credit score

There are a lot of credit score myths. Find out the truth behind the top five misconceptions people have. Read on!

Keep Reading

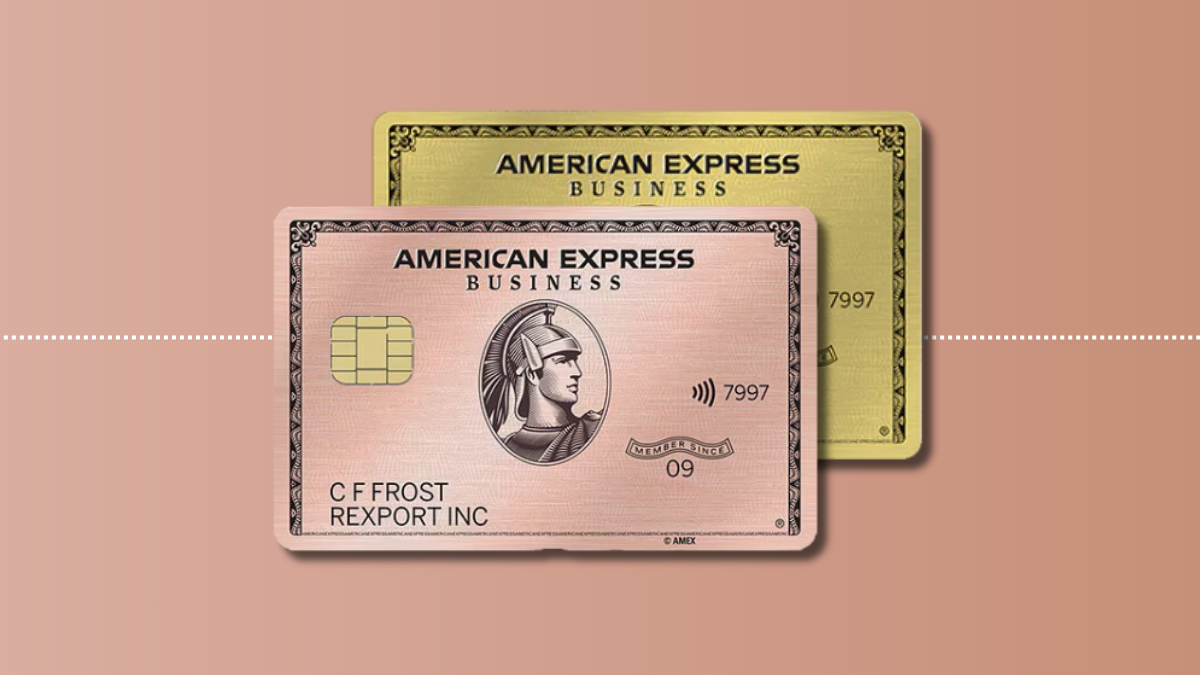

70K bonus points: Apply for American Express® Business Gold Card

Get an in-depth understanding of the American Express® Business Gold Card and its application process. Earn up to 4 points on purchases!

Keep Reading