Mortgage

Learn to apply easily for the Blue Sky Financial Mortgage

Fast and uncomplicated: that's how it feels like to apply for the Blue Sky Financial Mortgage with this guide. Enjoy personalized rates!

Advertisement

Blue Sky Financial Mortgage: apply in less than 5 minutes

Ready to save time and money? When you apply for the Blue Sky Financial Mortgage, you can complete your application in a mere 5 minutes!

This revolutionary process is changing the game with its quick online form. So let’s find out exactly how it works and determine what qualifications must be met! Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

Indeed, Blue Sky Financial Mortgage has one of the fastest and simple applications online. Here is the step-by-step:

1. Visit the website

The first step is to visit the Blue Sky website and inform your credit score.

The questionnaire is simple; unlike many other mortgage companies, you won’t need to provide your Social Security number or income information.

Plus, their system will automatically fill in most of the details, so you don’t have to spend an entire afternoon filling out forms.

Advertisement

2. Disclosure

So, after submitting your questionnaire, you’ll receive a variety of loan options.

From here, you can select one and move on to the disclosure process.

This part may take a little longer than 5 minutes as it requires additional paperwork such as tax returns or proof of employment—but not much else.

3. Closing

Once everything is finalized, the loan should be issued within a few days—or even on the same day, depending on which lender your loan goes through.

And just like that, you’re done! The entire process takes no more than 10 minutes from start to finish.

Advertisement

Requirements

Here is a list of some documents and requirements to apply for a Blue Sky Financial Mortgage:

- Copy of bank statements;

- Tax returns;

- Driver’s License;

- Credit score required for the loan type;

- Be a resident in one of the 8 states where the lender is available.

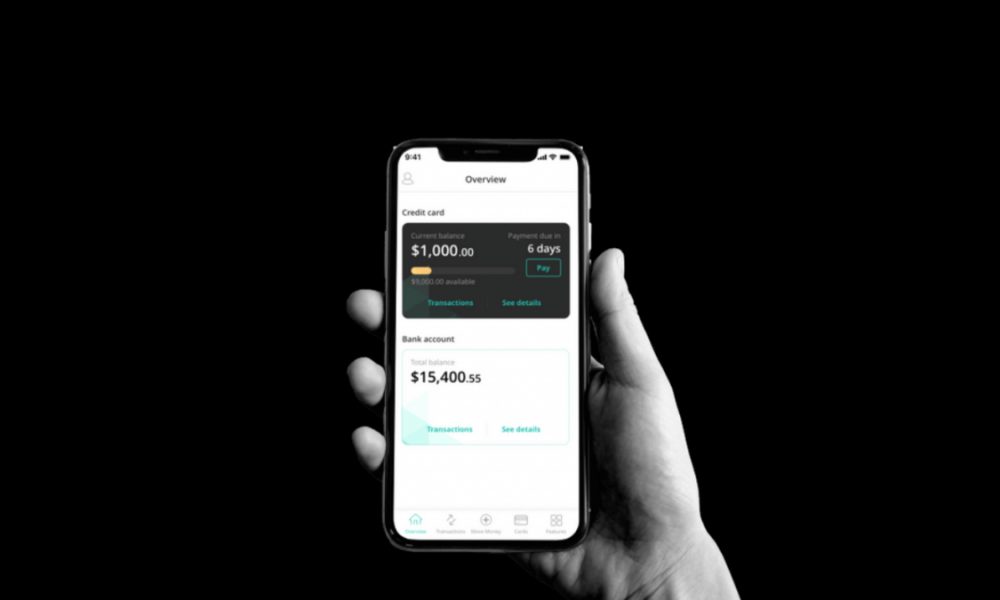

Apply using the app

Currently, Blue Sky Financials doesn’t have an app to apply for their loans. Still, you can apply through your mobile device!

So just follow the step-by-step provided above, and it’s done!

Blue Sky Financial Mortgage vs. Ally Bank Mortgage: which one is the best?

Indeed, with Blue Sky Financial, you’ll get personalized service with various lenders available to your needs and financial profile. However, you can only apply in 8 states.

In contrast, Ally Bank Mortgage’s strong suit is its online service and support nationwide. You can apply from 48 states.

Ultimately, only you can decide which mortgage provider will best fit you; take the time to weigh their features below.

| Blue Sky Financial Mortgage | Ally Bank Mortgage | |

| Credit Score | 680 or higher; | Jumbo: 700; Conventional: 620; |

| Loans Offered | Purchase, refinance, FHA, VA, Jumbo, Fixed-rate, Adjustable-rate; Conforming backed loans by Fannie Mae and Freddie Mac; | Purchase, Refinance, Jumbo, Fixed, Adjustable; |

| Minimum Down Payment | No minimum requirement; | 3%; |

| APR | Qualify for personalized rates; | There are variable or fixed rates depending on the loan; |

| Terms | 10-30 years. | 5,7, or 10 years. |

So are you ready to apply for an Ally Bank Mortgage online? Then keep reading to learn the steps to get there.

How to apply for Ally Bank Mortgage

Here's a full guide to apply for the Ally Bank Mortgage. Keep reading!

Trending Topics

Busy Days, Easy Meals: Time-Saving Airfryer Recipes in Minutes!

Cook delicious and crispy snacks with these 11 irresistible air fryer recipes anyone can make. Find out more!

Keep Reading

How to get a personal loan: 6 steps to secure funding

How to get a personal loan? Find out everything in this post: how much you can get and what score is necessary. Keep reading!

Keep Reading

Supplemental Security Income (SSI): see if you qualify

Learn more about the Supplemental Security Income (SSI) program and how to apply if you or a loved one needs assistance.

Keep ReadingYou may also like

American Airlines AAdvantage® MileUp® review: Fly with ease!

See the American Airlines AAdvantage® MileUp® review and discover how it allows you to earn rewards and save money. Read on!

Keep Reading

How to apply for the Sable bank account easily

If you're tired of old-fashioned banks, learn how to apply for a Sable bank account and enjoy your online account with a $0 annual fee.

Keep Reading

ClearMoneyLoans.com review: how does it work and is it good?

Get to know a personal loan lender platform that accepts different credit scores. Read on to a ClearMoneyLoans.com review.

Keep Reading