Credit Cards

The Definitive Guide to Apply for Blaze Mastercard® Credit Card

Want to fix your credit score? Discover the details to apply for the Blaze Mastercard® Credit Card now. Read on!

Advertisement

Confidently apply for the Blaze Mastercard® Credit Card with our definitive guide

Apply for the Blaze Mastercard® Credit Card with ease! We’re here to help you get started. Use it for online shopping, in-store purchases, and bill payments.

Further, check out our simple step-by-step guide in this blog post. Don’t miss out!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Indeed, to apply for the Blaze Mastercard® Credit Card, you have two options:

Option 1: Accept Mail Offer

If you received a mail offer, follow these steps:

First, visit the website and add the reservation number provided in the offer.

Then verify your email address and complete the acceptance form to verify your information and accept the offer.

Advertisement

Option 2: No mail offer

If you did not receive a mail offer, keep these requirements in mind before applying:

- You mustn’t have a Blaze Mastercard issued by First Savings Banks;

- Your debt-to-income ratio will be considered;

- You need at least a 570 credit score;

- You must be at least 18 years old and a U.S. resident;

- The offer is not available to active military personnel and dependents.

If you meet these requirements and are ready to apply, here’s what you need to do:

- Provide personal information such as your name, mailing address, and phone number;

- Submit financial information;

- Wait for a decision regarding your application.

Apply using the app

The app is not currently accepting applications for the Blaze Mastercard® Credit Card.

However, you can still download the app to manage your account and make payments once your application has been approved.

Advertisement

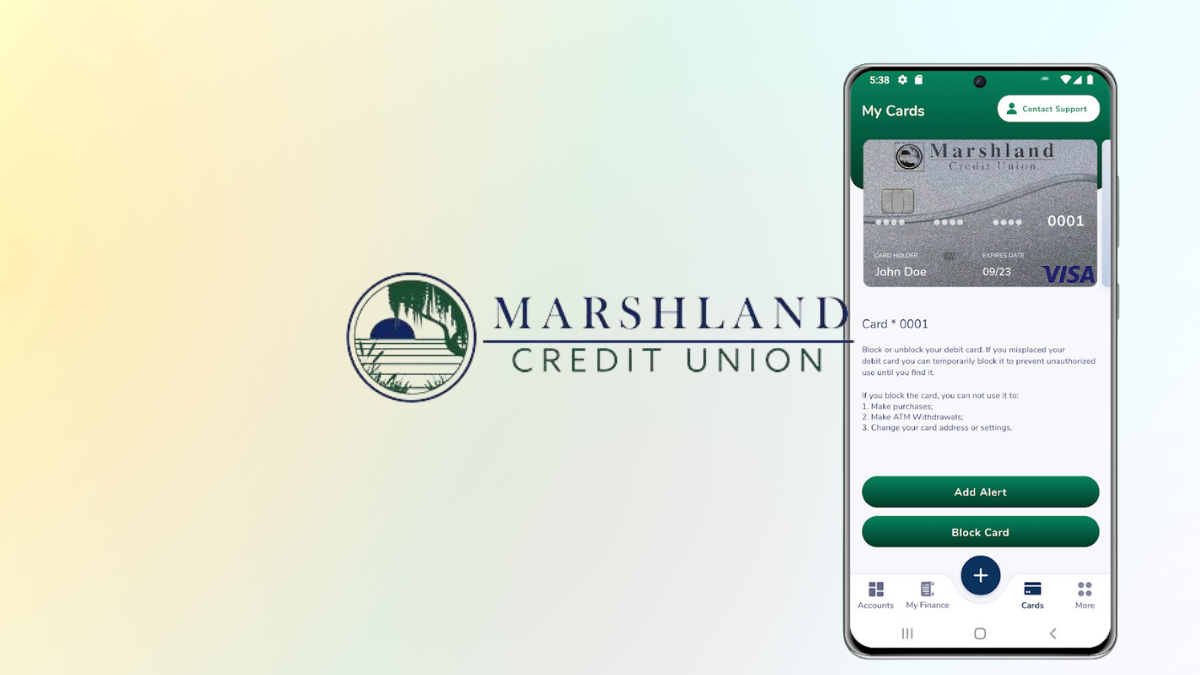

Blaze Mastercard® Credit Card vs. Marshland Visa® Credit Card

There are two credit cards to consider for building or repairing credit: the Blaze Mastercard® Credit Card and the Marshland Visa® Credit Card.

Then see the main features of each card below to help decide which one is best for you.

Blaze Mastercard® Credit Card

- Credit Score: Good – Excellent;

- Annual Fee: $75;

- Purchase APR: 29.9% Fixed;

- Cash Advance APR: 29.9% Fixed;

- Welcome Bonus: N/A;

- Rewards: N/A.

Marshland Visa® Credit Card

- Credit Score: Not disclosed;

- Annual Fee: $0;

- Purchase APR: 25-day grace period, after that 9,90%;

- Cash Advance APR: 9,90%;

- Welcome Bonus: N/A;

- Rewards: Earn 1 point on every dollar spent with your card.

Unlock a better credit score with the Marshland Visa® Credit Card! Further, discover insider tips on the application process now. Keep reading for more valuable info.

Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Trending Topics

Petal® 1 “No Annual Fee” Visa® Credit Card review: is it legit and worth it?

Petal® 1 "No Annual Fee" Visa® Credit Card will help boost your score. In this post, we'll take a closer look at its benefits!

Keep Reading

DoorDash Rewards Mastercard® review: Get up to 4% cash back on Food

We have the perfect card to earn $100 cash back bonus! Discover all about the DoorDash Rewards Mastercard® in this review. Read on!

Keep Reading

Petal 2 “Cash Back, No Fees” Visa Credit Card review

Looking for a no hidden fees, cash-back credit card? Check out this Petal 2 "Cash Back, No Fees" Visa Credit Card review. Read on!

Keep ReadingYou may also like

8 top apps to watch movies and series for free: download now!

Discover the best apps to watch movies and series for free. Stream your favorite genre anywhere with high-quality. Read on!

Keep Reading

PenFed Credit Union Personal Loans review: how does it work and is it good?

PenFed Credit Union Personal Loans review covers how it works and its pros and cons. Check out our post to learn more!

Keep Reading

Chase Bank Account application: how does it work?

Getting access to a Chase Bank Account is easy. In this article we're going to give you a quick walkthrough of the application process.

Keep Reading