Credit Cards

Prime Visa Credit Card: is it worth it?

Looking for the right credit card to suit your lifestyle? Find out why the Prime Visa Credit Card is the perfect choice. Learn more about its features and benefits in our full review!

Advertisement

Prime Visa Credit Card review: Earn up to 5% back on selected purchases!

Are you an Amazon loyalist looking for the perfect card to reward your spending habits? Then the Prime Visa Credit Card might be the right fit for your lifestyle!

In this review, we’ll take a look at this product’s main features and its perks and drawbacks. So, read on to learn more about what this card can do for you!

How do you get the Prime Visa Credit Card?

If you're an Amazon Prime member, the Prime Visa Credit Card is a great way to earn rewards on your purchases. Learn how to apply here!

| Credit Score | Good – Excellent. |

| Annual Fee | $0. |

| Regular APR | 19.49% – 27.49% variable. |

| Welcome bonus | Get a $100 Amazon Gift Card instantly upon approval exclusively for Prime members. |

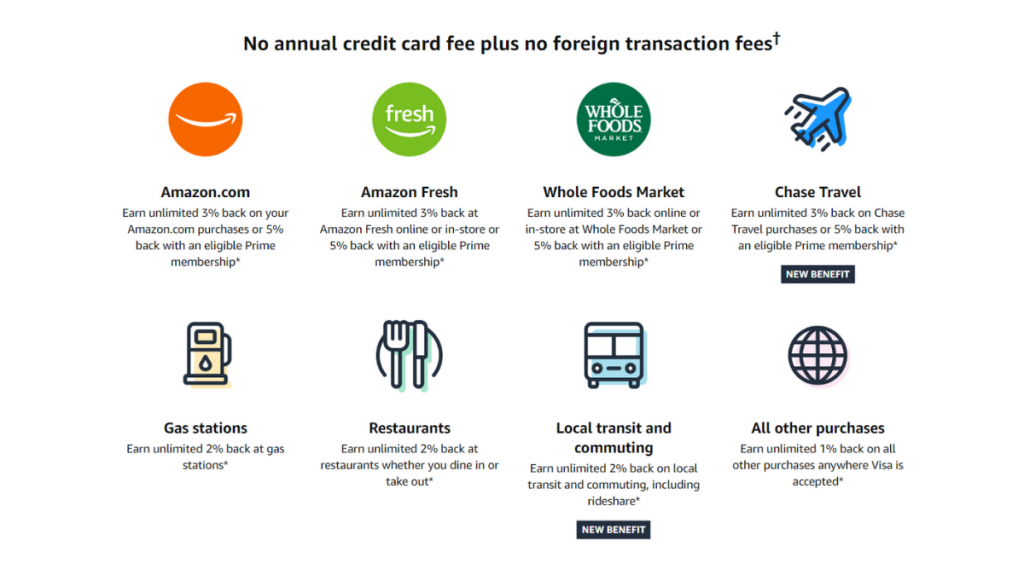

| Rewards | Earn unlimited 5% back at Amazon.com, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases with an eligible Prime membership, unlimited 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare), and unlimited 1% on all other purchases. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Prime Visa Credit Card

Issued by Chase and with a Visa Signature, the Prime Visa is accepted worldwide.

This product offers a 0% annual fee as well as no foreign transaction fees, which is perfect for any international purchases or traveling.

As rewards go, if you’re a frequent Amazon or Whole Foods customer, no other product can benefit you more.

You get 5% cash back from buying selected items at those places, and the flexible redemption options could mean anything from credit statements to money in your pocket.

But that’s not all! This card also provides a 2% cash back rate at restaurants, gas stations, and local transit. And you can get 1% back from any other purchase.

When you sign-up for a new account, Amazon throws in a handsome $100 gift card that you can use in whichever way you’d like (terms apply).

You must be an Amazon Prime member to be eligible for the card. The biggest downside to this product is that there is no intro APR for balance transfer or purchases.

Plus, if you don’t shop at Amazon or Whole Foods so much, it’ll be harder to maximize your earnings with this product.

Prime Visa Credit Card: should you get one?

If you’re an Amazon loyalist and a Whole Foods enthusiast, this is the best rewards card in the market for you, but it’s not limited to just those two options.

The 2% cash back on dining, for instance, can be used in your favor if you order in or out frequently.

Unlike many store-branded cards, you can use the Prime Visa card anywhere in the world that accepts Visa and earns bonus rewards with it.

You do have to be an Amazon Prime member to get it, and if you don’t shop much at Amazon or Whole Foods, many other options could benefit you more.

See the pros and cons of the Prime Visa Credit Card below.

Advertisement

Pros

- Get a $100 Amazon Gift Card instantly upon approval exclusively for Prime members.

- Earn unlimited 5% back at Amazon.com, Amazon Fresh, and Whole Foods Market with an eligible Prime membership.

- Earn unlimited 5% back on Chase Travel purchases with an eligible Prime membership.

- Earn unlimited 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare).

- Earn unlimited 1% back on all other purchases.

- No annual credit card fee.

- No more waiting. Redeem daily rewards at Amazon.com as soon as the next day.

- Member FDIC.

Cons

- Only available to Amazon Prime members.

- No 0% intro APR.

Advertisement

Credit score required

Like most rewards cards in the market, you need a credit score between good and excellent to get approved for an Prime Visa Credit Card.

Anything ranging from 690 to 850 in your FICO score could qualify you for an application.

Prime Visa Credit Card application: how to apply

Are you interested in signing up for the Prime Visa after learning just how much it can benefit you? We can help!

Follow the link below for more details about the application process and start earning rewards today!

How do you get the Prime Visa Credit Card?

If you're an Amazon Prime member, the Prime Visa Credit Card is a great way to earn rewards on your purchases. Learn how to apply here!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

US Bank Altitude® Go Visa Signature® Card review: is it worth it?

Enjoy introductory bonus and restaurant rewards with the US Bank Altitude® Go Visa Signature® credit card. Learn all about it!

Keep Reading

Cheap Avelo Airlines flights: fares from $29

Here is a complete guide to Avelo Airlines' cheap flights, their work, and the available destinations. Read on!

Keep Reading

Learn to apply easily for the Regional Finance Personal Loans

Do you want to apply for the Regional Finance Personal Loans? You can get the best loan options here! So, read on to learn how to apply!

Keep ReadingYou may also like

Credit card interest rates are rising, start paying it down now!

If you have high-interest credit card debt, now is the time for a plan of action. Read on for information on how you can pay it off.

Keep Reading

Macy’s Credit Card: Quick and Easy Way to Apply

Learn to apply for Macy's Credit Card, enjoy exclusive perks, and compare it with Torrid for smart shopping choices. Keep reading!

Keep Reading

Wayfair Credit Card application: how does it work?

Learn how to apply for the Wayfair credit card, and enjoy its multiple perks. No annual fee, cash back rewards! Learn here!

Keep Reading