Read on to learn about a card that can help you build credit!

First Progress Platinum Elite Mastercard® Secured Credit Card, bring up your bad credit!

Advertisement

A credit card designed to help rebuild your credit, the First Progress Platinum Elite Mastercard® Secured Credit Card is your chance. No credit score history required, and you’ll purchase online and in stores in just a few days. If you’re ready to start bringing up your credit, you found your way to get started.

A credit card designed to help rebuild your credit, the First Progress Platinum Elite Mastercard® Secured Credit Card is your chance. No credit score history required, and you’ll purchase online and in stores in just a few days. If you’re ready to start bringing up your credit, you found your way to get started.

You will remain in the same website

Don't waste any more time, we've put some of the benefits of the First Progress Platinum Elite Mastercard® Secured Credit Card together. Come and check them out!

You will remain in the same website

Navigating through the financial seas with the First Progress Platinum Elite Mastercard® Secured Credit Card illuminates a pathway to not only credit building but also to secured yet flexible spending.

This card marries the conventional utility of a credit card with the stabilizing aspect of secured funding.

Strengths and Special Offerings

- Credit Building Facilitation: The card reports to all three major credit bureaus, potentially providing a positive impact on your credit score with responsible usage.

- No Credit History Requirement: Accessible to individuals without an established credit history or with past credit struggles, acting as a financial tool to reboot or begin their credit journey.

- Security of a Secured Card: Your credit line is backed by a security deposit, providing a safety net and controlling your spending in alignment with your chosen deposit amount.

- Widespread Acceptance: With the Mastercard® brand, enjoy global acceptance, granting you the ease of use across myriad platforms and locations.

Limitations to Consider

- Annual Fee: The imposition of an annual fee can detract from the overall value gained from using the card, especially if spending are low.

- Potential for High APR: Possessing a relatively high APR may pose a risk of accumulating interest if the balance isn’t cleared monthly.

- Security Deposit: The requirement of an upfront security deposit, equivalent to the desired credit line, can be a barrier for some prospective users.

- Foreign Transaction Fees: Utilizing the card internationally may incur additional foreign transaction fees, which can accumulate and dilute your budget during travel.

- Limited Reward Structure: Lack of a structured reward or cashback system might lessen the allure for those seeking financial incentives for their spending.

While the First Progress Platinum Elite Mastercard® Secured Credit Card presents a promising ally in the pursuit of credit enhancement and secured spending, it brings along a bag of mixed facets.

It’s a tool that, when used adeptly, can propel your credit journey forward but requires mindful usage to sidestep potential financial pitfalls.

So, embark on this financial venture with a mapped-out plan to harness its offerings adeptly while navigating through its challenges seamlessly.

You won’t need to wait long to get your First Progress Platinum Elite Mastercard® Secured Credit Card after you complete your application and get approved to use the card. So, you won’t need to worry about waiting too long to get your physical card and start using it!

As a cardholder of the First Progress Platinum Elite Mastercard® Secured Credit Card, you’ll be able to get 24/7 online access to your account! This way, you’ll be able to manage your credit card’s features and finances online through the official mobile app!

Suppose you’re looking for a credit card with wide availability, and that accepts no credit history or a low credit score. In that case, the First Progress Platinum Elite Mastercard® Secured Credit Card can be an incredible card for your finances!

First Progress Platinum Elite Mastercard® Secured

Rebuild your credit score with the First Progress Platinum Elite Mastercard® Secured Credit Card. Learn more about the application process and start improving!

Are you looking for a card different from the First Progress Platinum Elite Mastercard® Secured Credit Card? If so, you can try to apply for the OpenSky Secured Visa card!

With this card, you’ll be able to improve your score and get perks! Therefore, you can check our post below to learn more about this card and see how to apply for it!

OpenSky Secured Visa card

The OpenSky Secured Visa card can help you establish or rebuild your credit. Don't let bad credit keep you from getting the things you need. Learn how to apply today!

Trending Topics

Navy Federal nRewards® Secured Card Review: Boost Your Credit

See the Navy Federal nRewards® Secured to build credit and earn rewards in our review. Here is all you need to know. Don't miss out!

Keep Reading

Learn to apply easily for ClearMoneyLoans.com

Here is a list of easy steps on how you can apply for ClearMoneyLoans.com. Keep reading to learn more about it!

Keep Reading

Accepted Account review: Great chances of approval for all credit scores

If you want to get discounts online on selected outlet products, read the Accepted Account review and know how. Keep reading!

Keep ReadingYou may also like

Application for the Discover it Student Chrome card: how does it work?

Apply for Discover it Student Chrome card. It offers solid rewards for students and a generous welcome bonus. Learn how to get yours.

Keep Reading

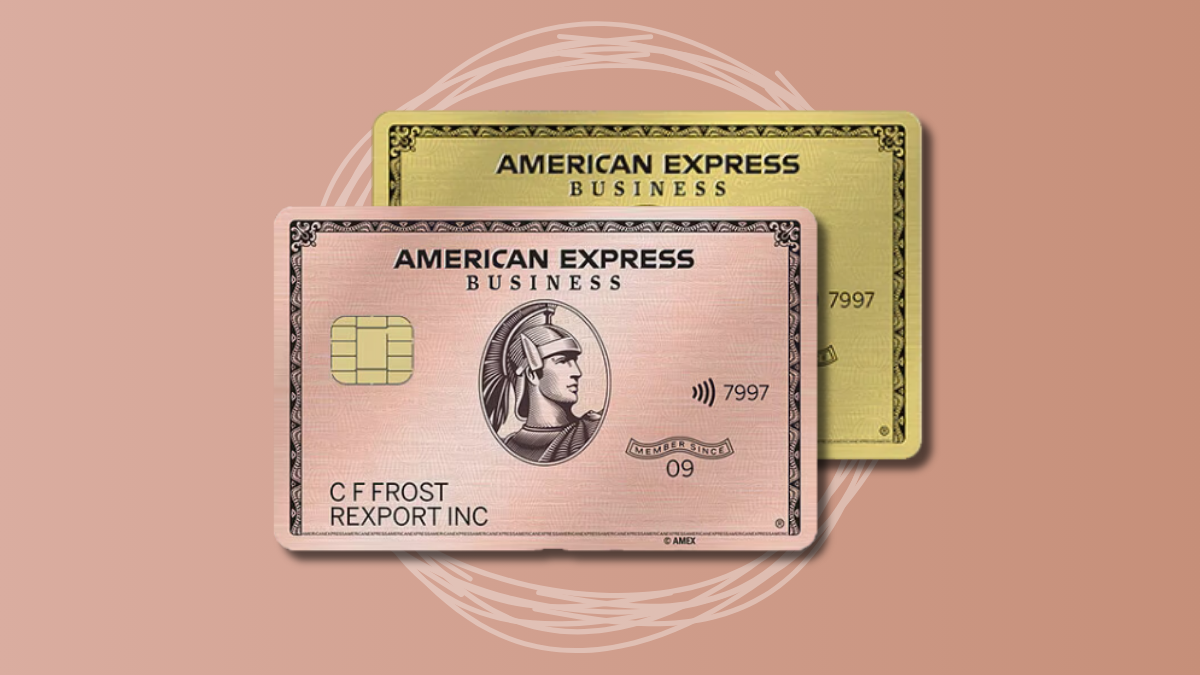

Gold benefits: American Express® Business Gold Card review

Read our American Express® Business Gold Card review and discover why this card is a must-have! Earn 70k bonus points and more!

Keep Reading

Red Arrow Loans review: how does it work and is it good?

Read our Read Arrow Loans review to learn more about this company and compare it to others in the market. Check it out!

Keep Reading