Read on to learn about a card with high cashback rewards for Costco members!

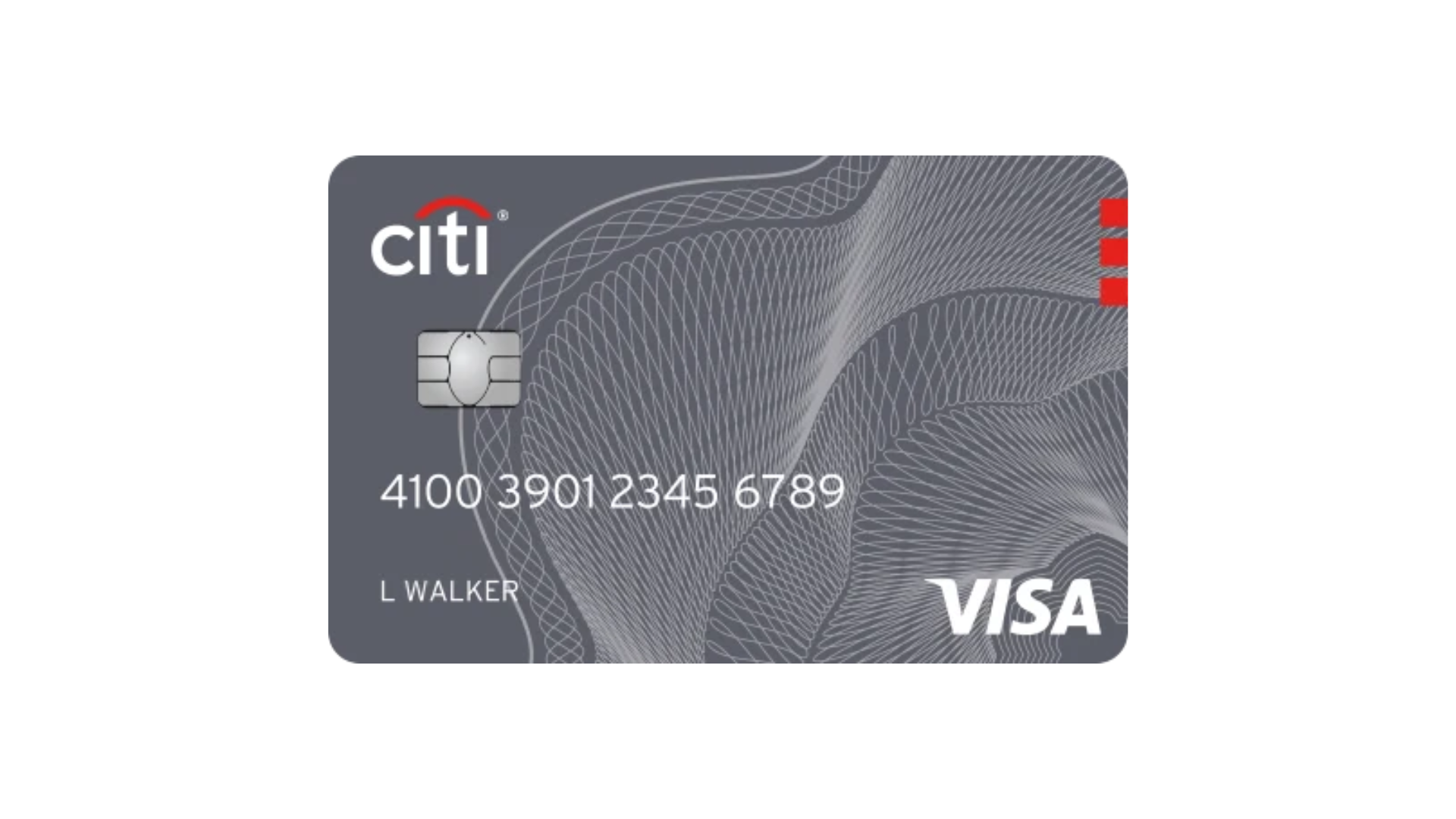

Costco Anywhere Visa® Card by Citi: a cash back card for Costco shoppers

Advertisement

Costco Anywhere Visa® Card Citi is a great way to get the most out of your Costco membership. With this card, you’ll earn cash back on all of your purchases, inside and outside Costco, both in-store and online. Plus, you won’t pay an annual fee. And because it’s a Visa card, you’ll be able to use it anywhere Visa is accepted.

Costco Anywhere Visa® Card Citi is a great way to get the most out of your Costco membership. With this card, you’ll earn cash back on all of your purchases, inside and outside Costco, both in-store and online. Plus, you won’t pay an annual fee. And because it’s a Visa card, you’ll be able to use it anywhere Visa is accepted.

You will remain in the same website

Check out the many attractive benefits that await you with a Costco Anywhere Visa® Card Citi!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Step into the world of wholesale wonders with the Costco Anywhere Visa® Card. Tailored for the discerning shopper who finds joy in bulk bargains and expansive aisles, this card magnifies the magic of every Costco visit, whether in-store or at the gas pump.

Strengths and Special Offerings

- Generous Cash Back on Gas: Fuel both your vehicle and your savings with a generous cash back rate at Costco gas stations and eligible gas stations worldwide.

- Dining and Travel Perks: Take your taste buds on a global tour, earning significant cash back on dining and eligible travel purchases everywhere.

- No Foreign Transaction Fees: Globe-trot with confidence without those pesky foreign transaction fees, making international adventures more affordable.

- Extended Warranty: Shopping gets an extra layer of assurance with the card's extended warranty protection on purchases.

- Citi Entertainment®: Get special access to purchase tickets to thousands of events, including presale tickets and exclusive experiences.

- Seamless Integration: As a cardmember, enjoy the simplicity of your Costco membership and credit card being combined into one card.

Limitations to Consider

- Membership Requirement: To access the card’s benefits, maintaining a Costco membership is essential, which comes with its own annual fee.

- Cash Back Redemption: Unlike instant rewards, cash back is provided annually in the form of a reward certificate redeemable for cash or merchandise Costco.

- No Introductory APR: Unlike some credit cards, there’s no 0% introductory APR offer for new purchases or balance transfers.

- High APR for Late Payments: There's a penalty APR for late payments which can significantly increase interest costs if you miss a payment deadline.

The Costco Anywhere Visa® Card is a treasure trove for loyal Costco patrons, transforming each bulk buy into a bouquet of benefits.

Its extensive rewards, especially on gas and dining, make it a compelling choice for many. However, the card shines brightest in the hands of those who frequent Costco's vast aisles and fuel stations.

If you're looking to amplify your Costco experience, this card could be your perfect shopping companion.

If you are a Costco member with an excellent credit history, you should apply for a Costco Anywhere Visa® Card by Citi. Also, you'll need to love to shop at Costco so that this can be worth it for you. Moreover, you'll be able to enjoy this card's benefits for no annual fee if you have a Costco membership.

Before you try to get the Costco Anywhere Visa® Card by Citi, you need to know that you need to have a Costco membership so you don't pay the annual fee. Also, you don't need to pay any foreign transaction fees. However, the card also has some common fees, such as APRs and purchase fees.

As a cardholder of the Costco Anywhere Visa® Card by Citi, you'll be able to earn cashback for all your purchases at Costco, and you'll get cashback for restaurant and eligible travel purchases! Plus, cashback is available for eligible gas and EV charging purchases worldwide! And there is much more!

If you think that the Costco Anywhere Visa® Card by Citi won't be good for your finances, you can try applying for the Walmart MoneyCard!

So, if you love shopping at Walmart, this can be the perfect card to get perks! Therefore, read our post below to learn more about this card and its application process!

Walmart MoneyCard application: how does it work?

Are you looking for a debit card to help you get cash back at Walmart? Read our post about the Walmart MoneyCard application!

Trending Topics

Shop Your Way Mastercard® review: up to 5% cash back

Explore the benefits of the Shop Your Way Mastercard® in our review – a no-annual-fee rewards card that earns you points on gas and dining!

Keep Reading

Learn to apply easily for the Ally Bank Mortgage

Here's a full guide to apply for the Ally Bank Mortgage without having to worry about the complications in the process. Keep reading!

Keep Reading

OppLoans Personal Loan review: how does it work and is it good?

Here is an OppLoans Personal Loan review with its features. Borrow up to $4K with no hidden fees! Keep reading to learn everything you need!

Keep ReadingYou may also like

Cheap Breeze Airways flights: Fly for less

Don't miss out on your chance to save big with Breeze Airways cheap flights! Prepare to take off into the skies - find flights 50% off!

Keep Reading

Apply for MoneyLion Loans: Easy Credit Builder

Stuck in credit limbo? Keep reading to learn how to apply for MoneyLion Loans to the rescue! NO hard inquiry!

Keep Reading

Red Arrow Loans review: how does it work and is it good?

Read our Read Arrow Loans review to learn more about this company and compare it to others in the market. Check it out!

Keep Reading