Reviews

Juno Checking Account review: Access crypto in a flash!

Get 5% cashback on 5 brands of your choice! Check out our Juno Checking account review to learn how! Let's get started!

Advertisement

Juno Checking Account: Get into crypto easily and earn 5% interest on your funds

Are you an investor looking for a way to access crypto easily? You can’t miss this Juno Checking Account review!

Juno Checking Account applicatio

Don't miss out on high-interest rates and 5% cashback! Learn how to apply for the Juno Checking account now. Stay tuned!

It offers a wide range of features and benefits that make it both convenient and rewarding. Let’s take an in-depth look at this account and its offerings. So keep reading!

- Fees: No monthly or overdraft fees;

- Minimum balance: No minimum balance;

- APY: 5% (depending on deposit).

- Credit score: No minimum credit score is required;

- Rewards: 5% cashback on 5 brands of your choice.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Juno Checking Account: how does it work?

Juno is an online banking platform that offers some excellent features. It is FDIC-insured up to access the additional features, you$250,000.

Also, it charges no monthly or overdraft fees, which will help you save your hard-earned money!

You can earn JCOIN (Juno currency) on every dollar you spend and unlock experiences and products.

And the APY is high! Up to 5% in interest when you make direct deposits.

Rewards

The best part about Juno Checking Account is that you can earn up to 5% cashback (in crypto if you want) on purchases when you pick up to five merchants, such as:

- Amazon;

- Target;

- Walmart;

- Disney+;

- Taco Bell;

- Netflix;

- Airbnb.

Additionally, you buy crypto in the app and invest using your cell phone. However, there is a cashback limit per year:

- Junior Basic: 5% on purchases of up to $500 annually;

- Junior Metal: 5% on purchases of up to $6,000 annually.

Advertisement

Other features

With this account, you can automatically invest part of every paycheck into crypto with dollar cost averaging.

Juno Checking Account allows users access to their funds 24/7 with direct deposit, so they never have to worry about not having access to their money when they need it most.

Additionally, users will receive real-time alerts whenever they purchase, so they always know where their money is going.

And if that wasn’t enough incentive for users, Juno also offers 24/7 customer service support should any issues arise or questions arise.

Also, they have more than 80k+ free ATMs spread around the country in stores such as 7-Eleven, Walgreens, and other locations.

Juno Checking Account: main features

Compare Juno Checking Account pros and cons below to help you decide if it’s a good option!

Advertisement

Pros

- Earn 5% interest;

- No monthly or overdraft fees;

- No minimum balance;

- Buy crypto from the app;

- 5% cash back on 5 stores of your choice. Amazon and Target included;

- FDIC insured.

Cons

- No savings account.

Credit score required

Banks and credit unions don’t typically require minimum scores to open checking accounts. So you open your Juno Checking Account even with bad credit!

However, your credit score might be considered when accessing some products or services.

Juno Checking Account application: how to do it?

Are you curious about the requirements and details of a Juno Checking Account application?

Our post below has all the info you want to know about it. Stay tuned!

Juno Checking Account applicatio

Don't miss out on high-interest rates and 5% cashback! Learn how to apply for the Juno Checking account now. Stay tuned!

Trending Topics

How to buy cheap Southwest Airlines flights

Get the scoop on how you buy cheap Southwest Airlines the next time you travel. Find where to look and how to save your cash. Read on!

Keep Reading

Red Arrow Loans review: how does it work and is it good?

Read our Read Arrow Loans review to learn more about this company and compare it to others in the market. Check it out!

Keep Reading

Apply for the Capital One Venture X Business: The Easy Way!

Make your business travels more rewarding with the Capital One Venture X Business card- here's our overview to apply. Stay tuned!

Keep ReadingYou may also like

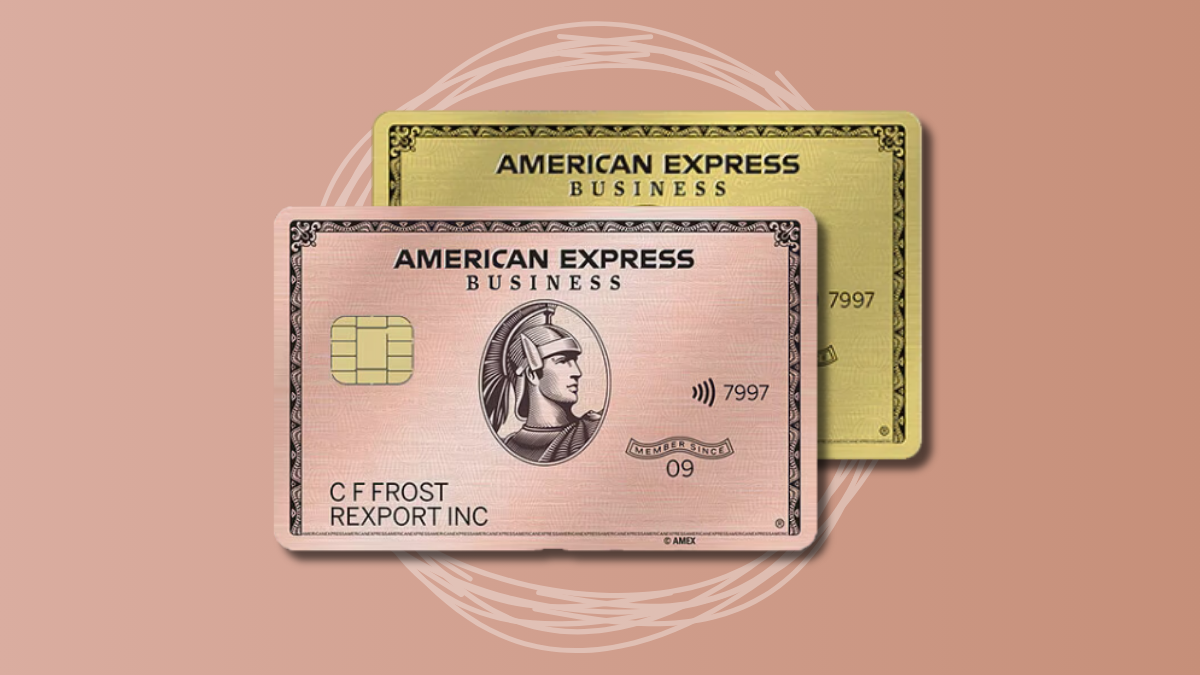

Gold benefits: American Express® Business Gold Card review

Read our American Express® Business Gold Card review and discover why this card is a must-have! Earn 70k bonus points and more!

Keep Reading

What Is a FICO Score? Understand the Basics

Demystifying your credit: What is the FICO Score? Learn how to improve it and take charge of your finances with our guide!

Keep Reading

Rocket Loans review: how does it work and is it good?

Get the financial flexibility you need with this Rocket Loans review! Up to $45,000 with fast funding. Read on and learn more.

Keep Reading