Credit Cards

FIT™ Platinum Mastercard® Card application: how does it work?

Do you think that applying for a credit card is hard? Think again! You can apply for the FIT™ Platinum Mastercard® in minutes, and get approved right away. Read this article to see how.

Advertisement

FIT™ Platinum Mastercard® Card: Get a credit limit up to $400

The FIT™ Platinum Mastercard® card is your ticket to new credit history.

You can get with a poor credit score and build your way up to a good or even excellent one. It depends on your commitment to being strict with your goal.

For an initial $99 annual fee (first year, then $125), you will receive a $400 credit limit. This is more than enough to use for your purchases and soon you’ll be the proud owner of an excellent score.

FIT™ Platinum Mastercard® will give you this chance when other credit card issuers don’t.

Apply online

It is one of the easiest application processes for a credit card you will ever see. You will do it online through the FIT™ Platinum Mastercard® card website, and the application form is right on the front page, first thing.

The application form requires information like this:

- Full name

- Complete address

- Checking account

- Be a U.S resident at least 18 years old

- Agree to receive physical and digital marketing content

And that is all for the application form. When you get approved, you’ll have to pay the $89 processing fee and you’ll soon receive your FIT™ Platinum Mastercard® card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

FIT™ Platinum Mastercard® vs. Capital One Guaranteed Mastercard®

Have you wondered how a credit card for credit building in Canada works? It is very similar. The Capital One Guaranteed Mastercard has a lower annual fee, and ofer some travel benefits too.

But the FIT™ Platinum Mastercard® is easier to get. If you’d like to apply for FIT® Platinum Mastercard®, you can also see how to apply for a Capital One Guaranteed Mastercard for comparison.

Apply for the Capital One Guaranteed Mastercard®

Apply for the Capital One Guaranteed Mastercard. It will not require your credit score, so don't worry about it. Keep reading to understand how to apply.

FIT™ Platinum Mastercard®

- Credit Score: Apply with poor, fair, or any credit score.

- Annual Fee: $99 introductory fee for the first year, then $125 thereafter.

- Monthly Fee: $0 introductory fee for the first year, then $150 thereafter (billed $12.50 per month).

- Processing Fee: $95 (one-time fee).

- Regular APR: 35.90% fixed APR.

- Welcome bonus: This card is currently not offering any kind of bonus when you sign-up for it.

- Rewards: No cash back or any other kind of reward on this card.

Capital One Guaranteed Mastercard

- Credit Score: Don’t worry, apply with the score you have.

- Annual Fee: $59 – $79

- Regular APR: This card’s APR goes from 19.8% to 21.9%

- Welcome bonus: You get no bonus when you get this card.

- Rewards: No rewards program when you use it.

Trending Topics

Apply for SimpleLoans123: Fast-track Approval

Unlock financial freedom! Apply for the SimpleLoans123 in just 3 steps with our easy-to-follow guide. Read on!

Keep Reading

0% intro APR: Apply for the PNC Core® Visa® Credit Card

Apply now for the PNC Core® Visa® Credit Card with our assistance. Learn what is required, where, and how to get it - $0 annual fee!

Keep Reading

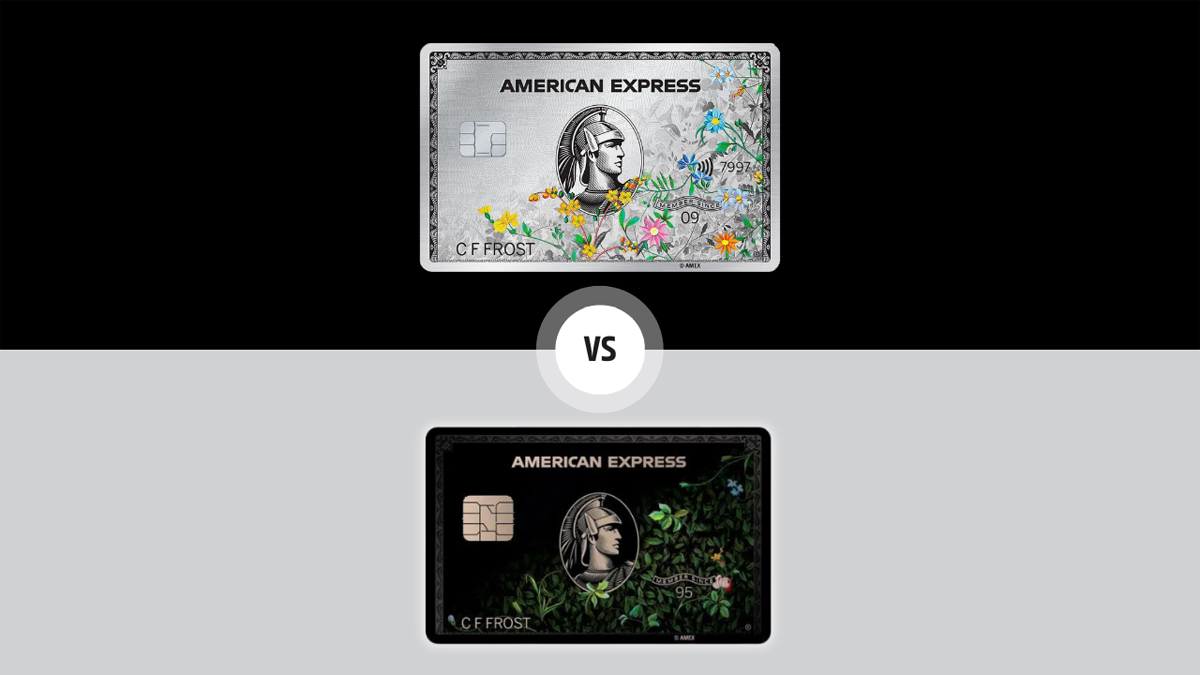

The Centurion® Card or The Platinum Card® from American Express: choose the best!

The Centurion® Card or The Platinum Card® from American Express? We've made a comparison to help you decide which is best.

Keep ReadingYou may also like

How to create an easy budget plan in 5 steps

Find out how to create a budget. Here are the steps to start and stick with a budget that will work for you.

Keep Reading

How to buy cheap American Airlines flights

Find out how you can buy cheap American Airlines flights for your next amazing trip. You can get discounts and the best perks. So, read on!

Keep Reading

Wells Fargo Active Cash® Card review

Read this Wells Fargo Active Cash® Card review and discover if this card is right for you! No annual fee! Earn cash back!

Keep Reading