Reviews

Chase College Checking℠ review: Get a $100 bonus

Learn more about the Chase College Checking℠ account and its features with our review! From student benefits to flexible banking options, it offers great solutions for college students!

Advertisement

Chase College Checking℠: Convenient features for busy college students

When you’re a college student, having the right bank account is essential. Today you can get a Chase College Checking℠ review and see if this could be the perfect fit.

How to apply for Chase College Checking℠

Wondering if the Chase College Checking℠ account is for you? Read on and learn how to apply! $100 sign-up bonus and more.

Students need a low-maintenance account with no hefty fees or minimums and offer perks like online bill pay and mobile banking services. Then let’s get into the details before you commit. Read on!

- Fees: Monthly fee- $0 to $6; Overdraft fee: $34; ATM out of Chase network fee: $3 to $5;

- Minimum balance: $5,000 or higher to avoid the monthly fee;

- APY: 0%;

- Credit score: No credit score is required;

- Rewards: $100 after making qualifying ten transactions when you open the account;

- Terms apply.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Chase College Checking℠: how does it work?

College students ages 17-24 can enjoy the benefits of a Chase College Checking℠ account, offering special perks and rewards. To open an account, you must prove that you are currently enrolled in school.

Earn a signup bonus of $100 after ten qualifying transactions within a 60-day period of coupon enrollment (see terms and conditions for more details). Who doesn’t love more money in their pocket?

Nevertheless, like most checking accounts, this one does not pay interest. However, it does have other features that make up for it.

This account charges a monthly service fee of up to $6. However, you won’t pay for it for up to 5 years if you’re a student of 17-24 years old at the account opening with proof of student status.

Also, you can waive the monthly fee if you keep a minimum balance of $5,000 or more in this account.

Plus, no minimum initial deposit is required to open an account online, so every penny counts.

Other Perks

The Chase College Checking℠ comes with other great features, such as:

- Fraud monitoring;

- Online bill pay;

- Mobile banking services;

- ATM access.

All these features make managing your money easier and allow you to track your spending habits better than ever before.

Advertisement

Chase College Checking℠: main features

Are you still wondering if Chase College Checking℠ is the right option? Then compare its pros and cons below to help you make a more informed decision.

Pros

- No monthly fee for up to 5 years in college;

- $100 bonus;

- National ATM access;

- Access online and in physical branches.

Advertisement

Cons

- No interest;

- It charges an out of the network fee.

Credit score required

Customers won’t need to go through a credit check to apply for the Chase College Checking℠. As a result, all types of credit are accepted.

Chase College Checking℠ application: how to do it?

This Chase College Checking℠ review has presented an excellent choice for those looking for a convenient and low-cost way to manage their money!

So, if you are a student considering applying for Chase College Checking℠, we can give you a few tips in our post below. Read on!

How to apply for Chase College Checking℠

Wondering if the Chase College Checking℠ account is for you? Read on and learn how to apply! $100 sign-up bonus and more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Merrick Bank Double Your Line® Secured Credit Card application: how does it work?

Ready to apply for the Merrick Bank Double Your Line® Secured Credit Card? Start improving your credit. Check out this post to learn more.

Keep Reading

Learn to apply easily for the NASB Mortgage

Want to know how to apply for the NASB mortgage? Follow this step-by-step guide! Several loan options and repayment flexibility! Read on!

Keep Reading

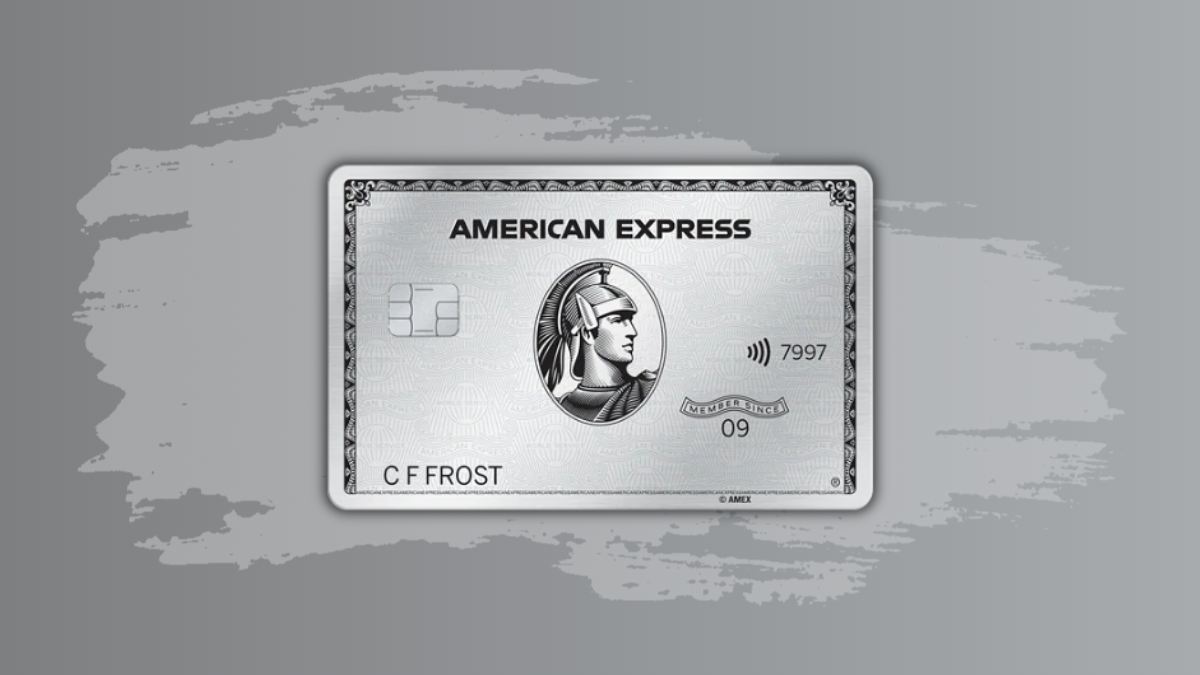

Apply for The Platinum Card® from American Express

It is simple to apply for The Platinum Card® from American Express. If you love getting benefits and traveling the world, apply now for it.

Keep ReadingYou may also like

Learn to apply easily for Better Mortgage

Do you want to apply for Better Mortgage but don't know how? This post will help you to understand it step-by-step. Read on!

Keep Reading

Learn to apply easily for the Veterans United Home Loans

Learn how to apply for the Veterans United Home Loans. Enjoy all the perks of this #1 VA Lender! Keep reading to learn more!

Keep Reading

Another bad week for Tesla’s stock prices

Tesla shares took another big hit this week. Will the latest fall endanger Elon Musk's deal to acquire Twitter? Read on for more!

Keep Reading