Reviews

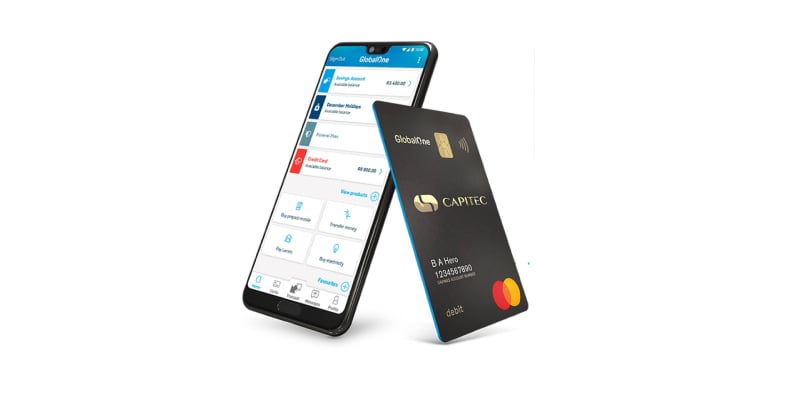

Capitec Bank App review: the easiest way to take care of your finances

The Capitec Bank mobile app review will tell you how to take control of your finances with a simple, easy-to-use interface that makes managing money faster and more convenient. Keep reading!

Advertisement

Use the Capitec Bank App to manage your account online

Do you need to take better care of your finances online and conveniently? The Capitec Bank App review will tell why this may be the perfect solution for you.

How to apply for Capitec Bank App

Need help with the Capitec Bank App download? This quick guide will show you how! Keep reading!

With this app, you can make banking easier, keeping track of your spending and budgeting. Keep reading to learn more about this handy app and how it can benefit you.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

About Capitec Bank

Capitec Bank is a South African retail bank that offers its services to individuals and businesses. The bank was founded in 2001 and has over 500 retail branches in South Africa.

It offers various banking products and services, including savings and checking accounts, loans, credit cards, and investment accounts.

What is the Capitec Bank App?

The launching of the Capitec Bank app was made to increase the bank’s customer base.

The user may check their account balance, transfer money between accounts, and make a payment all from their mobile device.

Advertisement

Capitec Bank App features

The Capitec Bank app is a great way to manage your finances on the go.

With the app, you can open a Capitec account, personalize your home screen, scan to pay, and create a personalized Pay me QR code.

Also, customize your favorites, track your spending, activate your virtual card, make contactless payments, and plan and manage your budget.

Money transfer between accounts

If you send money to someone at another bank, they can still get the payment as soon as you send it. There is a small fee of $7,50 for this service.

To send a payment, look for the “Transact” option in the app and select “Payments.” Then, choose the beneficiary or recipient and select the “Pay” button.

Enter the payment details and your Remote PIN to confirm the payment. That’s it! With just a few clicks, you can send money to anyone.

Advertisement

Manage your cards

This app has great features to manage your cards, such as contactless payment and setting and changing withdrawal and purchase limits anytime.

So you can keep a lower balance and control finances when things are tight.

Pay your bills

To pay your bills with this app, you can set automatic payments. Also, make immediate payments to avoid late fees.

Account balances

In the Capitec Bank App, you can instantly transfer funds from my account, even if you have a low balance, without any charges.

How to download the Capitec Bank App?

Did you enjoy the Capitec Bank App review and would like to know how to download it? Read our post below to learn how to do it!

How to apply for Capitec Bank App

Need help with the Capitec Bank App download? This quick guide will show you how! Keep reading!

Trending Topics

A guide to the best online banks in Canada 2022

Learn what you need to know about the best online banks in Canada and make an informed decision about your finances. Read on for more!

Keep Reading

First Phase Visa® Card review

The First Phase Visa® Card review is about a credit card designed to repair credit. If you find yourself in this situation, keep reading!

Keep Reading

How to buy cheap flights on Kayak

Do you want to save big on your flights? Check out how to buy cheap flights using Kayak. Flights from $29.99! Read on!

Keep ReadingYou may also like

Axos Bank Rewards Checking Account Review: Earn Amazing Rewards

Looking for a great rewards? Then take a closer look at this Axos Bank Rewards Checking Account review - earn up to $300 welcome bonus!

Keep Reading

The Business Platinum Card® from American Express review

Learn about the credit score needed and the perks of this incredible Amex card in the Business Platinum Card® from American Express review!

Keep Reading

Cheap Avelo Airlines flights: fares from $29

Here is a complete guide to Avelo Airlines' cheap flights, their work, and the available destinations. Read on!

Keep Reading