Credit Cards

BMO Ascend World Elite®* Mastercard®* Review

Experience elite travel benefits with the BMO Ascend World Elite®* Mastercard®*. Enjoy top-tier rewards, comprehensive insurance, and exclusive access to luxurious travel perks.

Advertisement

Enjoy a generous welcome bonus and up to 5x points on purchases!

Are you looking for a financial solution with an impressive set of rewards? Then this BMO Ascend World Elite®* Mastercard®* review is for you.

This cards offers points on every purchase, which are easily redeemable. Not to mention a fantastic welcome bonus! Curious? Then read on to see if this is the card for you.

Apply for the BMO Ascend World Elite®* Mastercard®

Learn how you can easily apply for the BMO Ascend World Elite®* Mastercard®* and start earning more value on your spending.

| Credit Score | Good/Excellent. |

| Annual Fee | $150 (waived in the first year as a member) |

| Regular APR | 20.99% on purchases; 23.99% for cash advances (21.99% for Quebec residents). |

| Welcome bonus | Earn up 60,000 bonus points. (Minimum spending required) |

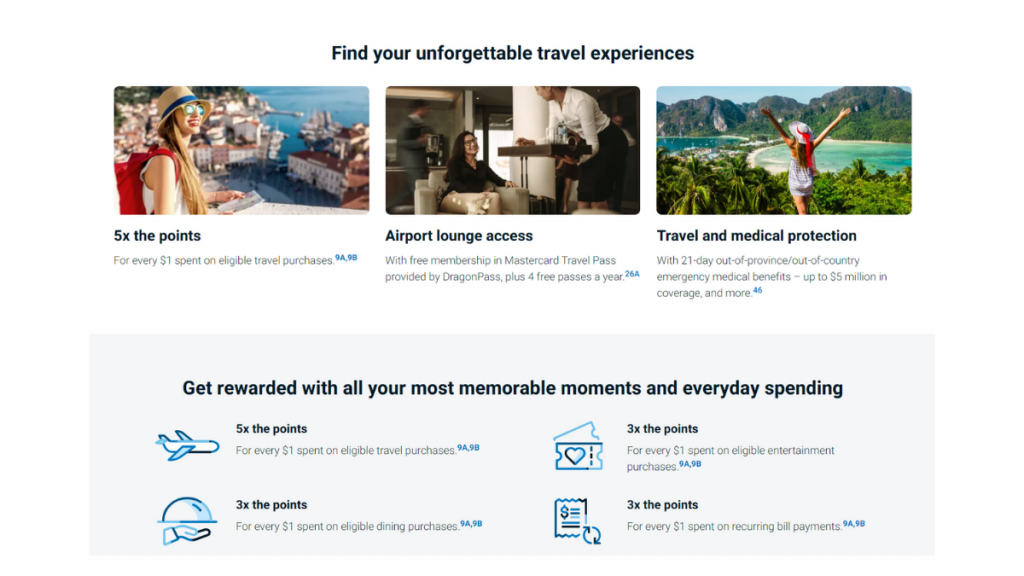

| Rewards | 5x points on travel 3x points on dining, entertainment, and recurring bills 1x points on every other purchase |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

BMO Ascend World Elite®* Mastercard®*: how does it work?

A good rewards rate and the generous welcome bonus are just some of the benefits you’ll get with the BMO Ascend World Elite®* Mastercard®*.

With this card, you’ll be able to enjoy the reliability of a Mastercard signature that has excellent acceptance everywhere.

Although it has good travel benefits, it is not the best option to take abroad because it charges foreign transaction fees.

But you can use it to purchase your air tickets and rent cars while earning points to redeem for more trips.

You can count on four complimentary visits to airport lounges and the great travel insurance coverage granted by Mastercard.

BMO Ascend World Elite®* Mastercard®*: should you get one?

If you’re looking for a credit card with reward points and no complicated bonus categories, the BMO Ascend World Elite®* Mastercard®* is a good option.

Advertisement

Pros

- The welcome bonus will give you 60,000 bonus points and you won’t pay the annual fee for the first year.

- Flexible reward points program, which allows you to redeem them for travel, merchandise, a statement credit, or investment at BMO.

- Excellent travel insurance.

- Earn four complimentary access to airport lounges and membership in Mastercard Airport Experience.

Cons

- Required a good or excellent credit score and a minimum annual income for the application process.

- It is not the best option to use abroad because it charges a foreign transaction fee.

- Has a $150 annual fee after the first year.

Advertisement

Credit scores required

BMO has a high standard for this card. To have one, you need a good or excellent credit score.

Also, you need a good total annual income too, of at least $80,000 – or $150,000 per household.

BMO Ascend World Elite®* application: how to do?

This review brought to you everything this card has to offer. Did you like it? Are you considering getting one for yourself?

To apply for it is easy, and you can do it right now. Read the next content here to learn how to ask for your new credit card.

Apply for the BMO Ascend World Elite®* Mastercard®

Learn how you can easily apply for the BMO Ascend World Elite®* Mastercard®* and start earning more value on your spending.

Trending Topics

Application for the Fortiva® Card: how does it work?

If you need an incredible card that you can get even with a fair credit score, check out the Fortiva® Card application!

Keep Reading

Achieve your goals easily: Avant Credit Card review

Want to build your credit without confusing rewards? Check out our review of the Avant Credit Card - the simple solution for better credit.

Keep Reading

Wayfair Credit Card review

Read out the Wayfair Credit Card review and learn how this card works. Cash back rewards and welcome bonuses! Keep reading to learn more!

Keep ReadingYou may also like

The Centurion® Card from American Express review: is it worth it?

Only 1% of the world can qualify for The Centurion® Card from American Express. Keep reading to know if it's worth the price.

Keep Reading

SoFi Personal Loans review: how does it work and is it good?

In this SoFi Personal Loans review, you'll learn how it works, the benefits, and if they're a good fit for you. Read on!

Keep Reading

American Airlines AAdvantage® MileUp® review: Fly with ease!

See the American Airlines AAdvantage® MileUp® review and discover how it allows you to earn rewards and save money. Read on!

Keep Reading