Credit Cards

How to Apply for the X1 Credit Card and Get the Best Rewards

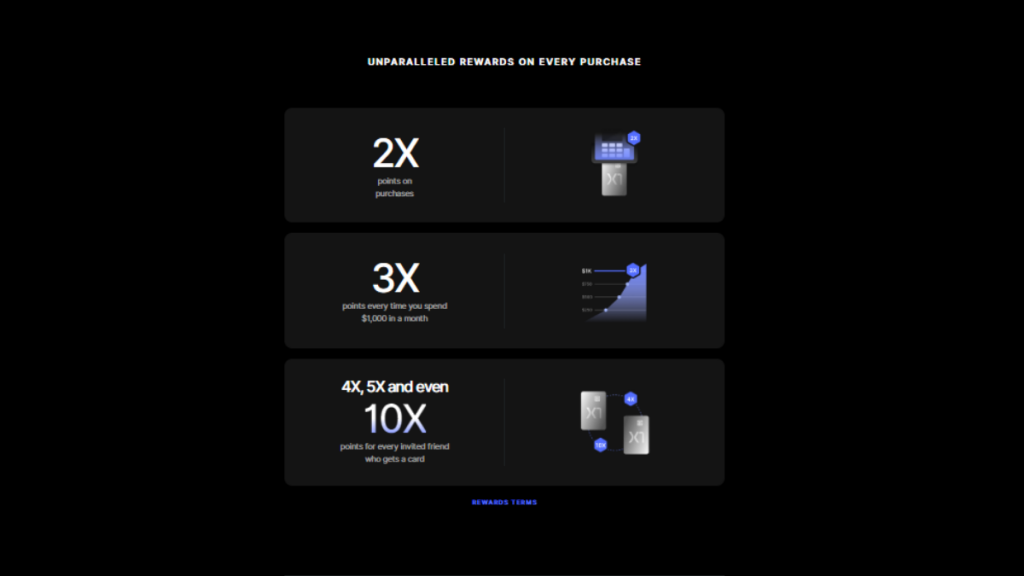

Looking for a rewards credit card you can trust? Learn how to apply online for the X1 Credit Card. Earn up to 10X points - keep reading and learn more!

Advertisement

A Credit Card With Unique Benefits That Will Help You Build Your Credit Score

The X1 Credit Card is a top-rated, rewarding credit card with no annual fees- and best of all, you can learn how to apply here!

Keep reading for a step-by-step guide on how to apply easily and even boost your credit score!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The best way to apply for the X1 card is online. By submitting an application online, customers can qualify for a credit decision within minutes.

Additionally, customers who apply online may be eligible for exclusive offers and discounts. Here is the step-by-step:

- Firstly, head over to the official website of the X1 Credit Card;

- There, locate and find the “Apply Now” button;

- Then, fill out their questions about your details and finances;

- Enter your name, date of birth, Social Security Number, email, and phone number.

After submitting the information requested, continue, and wait for approval.

Notably, one distinctive feature of the X1 Credit Card application process is their use of a soft inquiry so that it won’t affect your score.

Apply using the app

The option to apply for the X1 credit card via the app is unavailable.

Advertisement

X1 Credit Card vs. Petal® 2 “Cash Back, No Fees” Visa® Credit Card

One card often compared to the X1 Credit Card is the Petal® 2 “Cash Back, No Fees” Visa® Credit Card.

While both cards offer rewards, the X1 Credit Card offers up to 2 points back on all purchases, while the Petal® 2 card provides up to 1% cashback.

Additionally, both cards don’t have welcome bonuses, but they help boost your score.

Ultimately, whether you choose the X1 Credit Card or another one depends on what kind of rewards you’re looking for.

Be sure to compare the features of each card below.

X1 Credit Card

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Purchase APR: 20.24% – 30.24% (variable);

- Cash Advance APR: 30.24% (variable);

- Welcome Bonus: N/A;

- Rewards: Earn 2 points on all purchases; Earn 3 points per dollar spent on your next $7.5k purchases in a month after spending $1k already. Up to 10X points for every invited friend who gets the X1 Credit Card.

Advertisement

Petal® 2 “Cash Back, No Fees” Visa® Credit Card

- Credit Score: 630-850 (Average – Excellent);

- Annual Fee: No annual fee;

- Regular APR: 17.99% – 31.99%;

- Welcome bonus: No welcome bonus;

- Rewards: 1% cash back on eligible purchases, up to 1,5% cash back when cardholders pay on time; also, 2%-10% bonus cash back at some eligible merchants.

Start your application for Petal® 2 “Cash Back, No Fees” Visa® Credit Card by following our instructions below. Read on!

How to apply for Petal 2 Visa Credit Card

Do you know how to apply for the new Petal 2 "Cash Back, No Fees" Visa Credit Card? Read our step-by-step guide on how to go through the process.

Trending Topics

Merrick Bank Double Your Line® Secured Credit Card application: how does it work?

Ready to apply for the Merrick Bank Double Your Line® Secured Credit Card? Start improving your credit. Check out this post to learn more.

Keep Reading

Application for the Fortiva® Card: how does it work?

If you need an incredible card that you can get even with a fair credit score, check out the Fortiva® Card application!

Keep Reading

National School Lunch Program (NSLP): Assistance for Children

Discover how the National School Lunch Program (NSLP) provides assistance to poverty-stricken children and families. Learn more!

Keep ReadingYou may also like

American Express® Gold Card Review: earn rewards when traveling

This is an American Express® Gold Card review about its benefits. Read on to know about the rewards program, fees, and more.

Keep Reading

How to Become an Investor: 8 Essential Steps for Beginners

Want to know how to become an investor? Explore our beginner's guide with insights for a successful investment journey.

Keep Reading

A major drop and stablecoin collapse cause a wild week among cryptocurrencies

In the past week, the prices of Bitcoin and other cryptocurrencies have seen major dips while a stablecoin has taken a plunge.

Keep Reading