Credit Cards

Apply for Unique Platinum Card: quick and simple

Unlock a world of opportunities with the Unique Platinum Card - with 0% APR, this is the perfect card to build credit! Read on and learn more!

Advertisement

Online and fast application for obtaining funds

Important Notice: The Unique Platinum Card is no longer available for new applicants. This article remains active for informational purposes only and may contain details that are no longer valid. We recommend checking other available credit cards in the market to find an option that suits your needs.

Are you looking for a credit card that can take your spending power to the next level? Then apply for the Unique Platinum Card today!

In this article, we’ll discuss how to apply for the Unique Platinum Card, including applying online and through the app. So keep reading and learn more!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

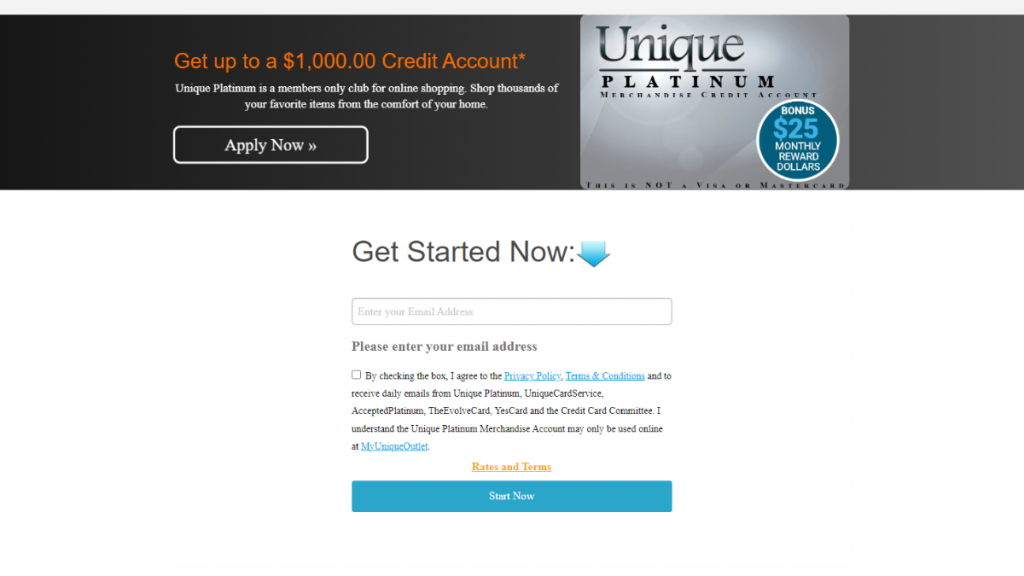

Apply online

To apply for the Unique Platinum Card online, visit their website and fill out an application form.

You’ll be asked to provide personal information such as your name, address, and social security number, as well as your employment and financial details.

You’ll also need to consent to a credit check to determine if you’re eligible for the card and what your credit limit will be.

Once you’ve submitted your application, the Unique Platinum Card team will review it and determine your approval.

Apply using the app

Indeed, the Unique Platinum Card won’t offer a mobile app to its cardholders. Still, you can apply for this card through your mobile device.

You’ll only need to access their official website and follow the step-by-step we’ve provided above!

Advertisement

Unique Platinum Card vs. Best Egg Visa® Credit Card

The Unique Platinum Card offers a high credit limit and exclusive benefits, but it does come with a monthly fee.

If you’re looking for a credit card with no annual fee, the Best Egg Visa® Credit Card might be a better choice.

It accepts applicants with all types of credit and allows you to rebuild it with time! Also, it charges no annual fee!

Compare both card’s main features below to help you decide which is best for you!

Unique Platinum Card

- Credit Score: Poor – bad – limited;

- Annual Fee: Monthly membership fee of $19.95;

- Purchase APR: None;

- Cash Advance APR: N/A;

- Welcome Bonus: None;

- Rewards: None.

Advertisement

Best Egg Visa® Credit Card

- Credit Score: Fair/Poor;

- Annual Fee: $0;

- Purchase APR: 18.99% – 29.99%;

- Cash Advance Fee: N/A;

- Welcome Bonus: N/A;

- Rewards: N/A;

If you’re looking for a credit card with no annual fee, the Best Egg Visa® Credit Card might be a better choice.

So, check out more about how to apply for this option.

Apply for Best Egg Visa® Credit Card

Learn how to apply for the Best Egg Visa® Credit Card and how it can help give you peace of mind – get the result in minutes! Keep reading!

Trending Topics

Deserve® EDU Mastercard for Students review

Check this Deserve® EDU Mastercard for Students review and learn how to earn cash back while building a solid credit score!

Keep Reading

Delta SkyMiles® Platinum American Express Card application

Do you love to travel and earn card perks while doing so? Read our post about the Delta SkyMiles® Platinum American Express Card application!

Keep Reading

Learn the 5 best credit cards with travel perks: enjoy in 2022!

We've made a list of the best travel perks credit cards for you to make the best out of every trip. Read on to choose yours and enjoy it!

Keep ReadingYou may also like

What is a reverse mortgage and should you get one?

What is a reverse mortgage? Here's what you need to know before making your decision. Keep reading to find out!

Keep Reading

What to do if I didn’t get my Stimulus Check? [2023]

Here are some tips on what to do if you're one of the millions of Americans who haven't received their stimulus check yet. Read on!

Keep Reading

Costco Anywhere Visa® Business Card by Citi application: how does it work?

Learn how to apply for the Costco Anywhere Visa® Business Card by Citi, and enjoy the cashback options. Read on!

Keep Reading