Credit Cards

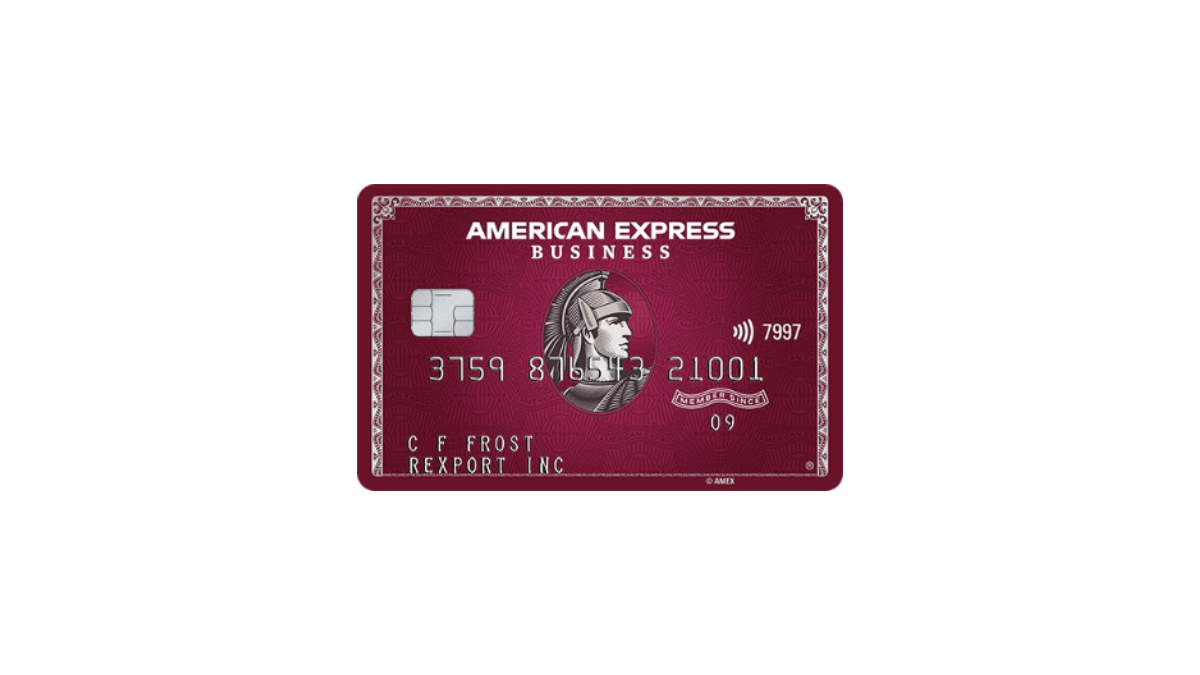

The Plum Card® from American Express application: How does it work?

We broke down the application process for the Plum Card® from American Express for you. Get started here. No APR or foreign transaction fee!

Advertisement

Earn 1,5% cash back on all early payments!

Are you a small business owner looking for a powerful, flexible credit card? The Plum Card® from American Express might be right for you.

In this post, we’ll explain the application process so you can decide if it’s the right fit for your business. Then read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Applying for the Plum Card® from American Express is simple; you can do it online anytime.

Firstly, you must visit the American Express website, find the Plum Card® page, and look for the application form.

Then you must provide standard information when applying, such as your income, name, address, date of birth, credit score, and Social Security number.

Once you submit your application, Amex will respond with approval. Easy like that!

Requirements

As requirements to get this credit card, you must:

- Be at least 18 years old;

- Have a valid social security number;

- Be an American citizen or authorized resident;

- Have a good or excellent credit score.

Advertisement

Apply using the app

The American Express app does not qualify applicants for new cards; if interested in applying, go to their website directly.

However, the app is a one-stop for convenient account management and exploring your card’s benefits.

You can access all its Android or iPhone features, allowing you to check balances and make payments.

The Plum Card® from American Express vs. Discover it® Miles Credit Card

This business credit card is flexible with payment: pay early and earn 1.5% cash back.

The Discover it® Miles Credit Card, it’s a practical card for travelers. Instead of cash back, you can earn 1.5 miles on every purchase.

So, what’s your choice? A business card or a travel one? It’s up to you. Weigh their features below, and see which card should be in your wallet next.

Advertisement

The Plum Card® from American Express

- Credit Score: Good-Excellent.

- Annual Fee: $250.

- Regular APR: N/A.

- Welcome bonus: N/A.

- Rewards: Get an unlimited 1.5% Early Pay Discount on eligible charges within 10 days of your statement closing date and see the discount applied to your next statement when you pay at the least the Minimum Payment Due by the Please Pay By date.

- See Rates & Fees

Discover it® Miles Credit Card

- Credit Score: Good – Excellent;

- Annual Fee: No annual fee;

- Regular APR: 0% for 15 months, then 16.49% to 27.49% variable, depending on your creditworthiness;

- Welcome bonus: Total miles earned in the first year of the account will be doubled;

- Rewards: 1.5 miles on every purchase.

Ready to earn miles on your purchases? So stay tuned: we’ll help you to apply for the Discover it® Miles Credit Card!

Discover it® Miles Credit Card application

Learn how to apply for the Discover it® Miles Credit Card. Pay no annual fee and earn miles on purchases. Read on and learn more.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Macy’s Credit Card Review: enjoy amazing benefits

Shop smart at Macy's! Dive into our comprehensive Macy's Credit Card review to discover exclusive discounts and perks. Read on!

Keep Reading

Children’s Health Insurance Program (CHIP): Find an Affordable Child Care

Find out more about how the Children's Health Insurance Program (CHIP) works and what it covers. Keep reading!

Keep Reading

Learn to apply easily for the Blue Sky Financial Mortgage

Apply for the Blue Sky Financial Mortgage with this guide. Find the perfect lender for your needs! Enjoy personalized rates! Read on!

Keep ReadingYou may also like

Ink Business Cash® Credit Card Review: up to 5% Cash Back

Here is the right card for small businesses - no annual fee, extra employee cards. Check out our review of the Ink Business Cash® Credit Card.

Keep Reading

How to budget for your first house

Here's a step-by-step guide to teach you how to budget for a house without breaking the bank. Keep reading!

Keep Reading

Learn to apply easily for Better Mortgage

Do you want to apply for Better Mortgage but don't know how? This post will help you to understand it step-by-step. Read on!

Keep Reading