Credit Cards

Milestone Mastercard – Unsecured For Less Than Perfect Credit application

Learn more about the Milestone Mastercard and how to get pre-approved without hurting your credit score. Qualify with poor credit!

Advertisement

Get pre-approval without hurting your score!

Looking to build your credit score but unsure where to start? The Milestone Mastercard – Unsecured For Less Than Perfect Credit is a great option for those with bad or no credit.

Read on to learn how to apply and get rid of bad credit in months! So if you’re ready, let’s get started!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Advertisement

Apply online

The Milestone Mastercard – Unsecured For Less Than Perfect Credit is a satisfactory unsecured card for people with low credit scores.

It reports payments to all three credit bureaus in the U.S., so you can start building your score without putting money down as a deposit.

Follow the steps below to apply in fewer than 3 minutes!

1. Pre-qualification process

The first step is completing pre-qualification. Milestone requires personal information like name, address, city, state, and email address.

Once you submit this information, Milestone will review your application profile and respond if you are pre-approved for one of their offers.

Advertisement

2. Review the Offer Terms & Conditions

If you are approved, you’ll have access to read through the terms and conditions associated with that offer before deciding whether or not it’s right for you.

One important thing to note is that this process has no hard inquiry; it will not affect your credit score at all.

3. Submit the application & get approved

Once you’ve decided that an offer from Milestone is right for you, complete the application process and await approval.

Depending on your credit score and other factors, approval may take a few minutes up to 48 hours.

After approval, your new card should arrive within 7 – 10 business days. Then you can activate it immediately.

Milestone will report your payments to improve your score.

Advertisement

Apply using the app

If you want to capitalize on this card’s amazing features, download their app and get full control over your balance, transaction history, and payment notifications.

But if you want to apply for this card’s benefits, don’t forget to visit their website!

Milestone Mastercard – Unsecured For Less Than Perfect Credit vs. First Access Visa® Card

Options for damaged credit scores, the Milestone Mastercard – Unsecured For Less Than Perfect Credit, and First Access Visa® are far from serving the same audience.

The First Access Visa® Card can be costly, charging a one-time fee plus a higher annual fee than the Milestone Mastercard Unsecured card.

So, if you are on your way to building a healthy financial status, you’d better compare these options first. Check some of them below.

Milestone Mastercard – Unsecured For Less Than Perfect Credit

- Credit Score: Poor/Bad;

- Annual Fee: See terms;

- Regular APR: See terms;

- Welcome bonus: N/A;

- Rewards: N/A.

First Access Visa® Card

- Credit Score: Bad to fair credit;

- Annual Fee: $75.00 for the first year. After that, $48.00;

- Regular APR: A fixed 35.99% APR;

- Welcome bonus: There’s no welcome bonus;

- Rewards: There are no rewards.

Find out more about the First Access Visa® Card, learn how to apply, and what fees to expect in our post below. Keep reading!

How to apply for First Access Visa® Card

Learn how the First Access Visa® Card application works and why you should consider applying for this credit card. Keep reading!

Trending Topics

Earn more: Marriott Bonvoy Business® American Express® Card review

Discover the ultimate business hotel card with our Marriott Bonvoy Business® American Express® Card review - earn valuable points!

Keep Reading

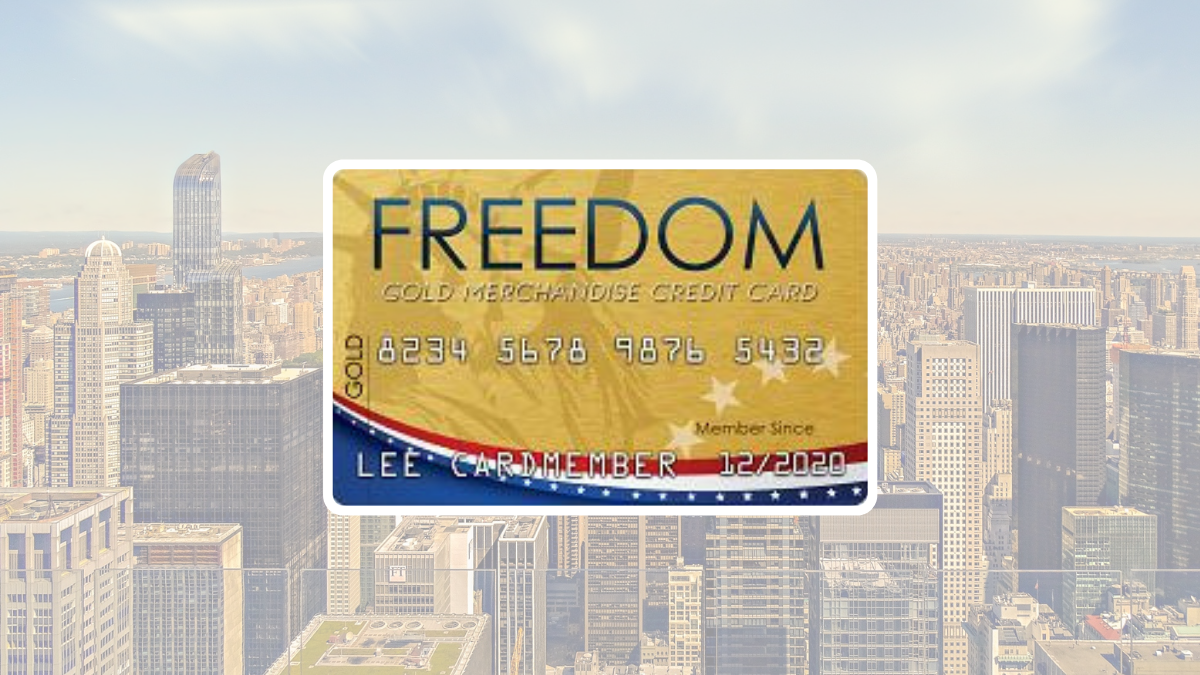

Application for the Freedom Gold card: how does it work?

Get your Freedom Gold card to buy everything you need from the Horizon Outlet. The application is easy and you can make it right now.

Keep Reading

Group One Platinum Card application: how does it work?

Learn how to apply for the Group One Platinum Card in easy steps. You can qualify for this card with no credit check! Read on for more!

Keep ReadingYou may also like

DoorDash Rewards Mastercard® application: how does it work?

Would you like to apply for the DoorDash Rewards Mastercard®? Follow this simple guide to learn how. Earn a $100 cash bonus and more!

Keep Reading

123 Money Loans Review: Payday Loans for All Credit Scores

Explore the pros and cons of 123 Money Loans in our review. From quick cash to potential pitfalls, make an informed decision!

Keep Reading

The best credit cards in the US for 2022

Learn today what are the best credit cards in the US and start earning rewards and enjoying many benefits and perks in 2022!

Keep Reading