Reviews

Marriott Bonvoy Boundless® Credit Card application: how does it work?

Looking for an easy way to gain travel rewards? Consider applying for the Marriott Bonvoy Boundless® Credit Card and start enjoying amazing benefits! Here are a few simple steps to get started on your journey.

Advertisement

Marriott Bonvoy Boundless® Credit Card: Enhancing your hotel experiences!

The Marriott Bonvoy Boundless® Credit Card is a great option for those looking to make their travel adventures even more rewarding.

With this card, you can enjoy rewards such as free nights, purchase points, and exclusive access to members-only offers.

But how do you go about applying for this Marriott Bonvoy Boundless®? Let’s take a look at all of the steps involved!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Marriott Bonvoy Boundless® Credit Card is a great option for those seeking the convenience and rewards of having a credit card.

Applying for it is relatively straightforward; visit Marriott’s website to start the application process.

You’ll be asked to provide personal information, such as your address, contact number, and social security number, and specify the type of account you’d like to open.

Marriott also offers bonuses exclusive to customers who apply and are approved – so don’t miss out on these rewards.

Apply using the app

Customers can only apply for the Marriott Bonvoy through the official website. However, cardholders can enjoy an excellent mobile app.

The Chase Mobile is available for Android and iOS. Customers can manage their credit cards, make payments, and more.

Advertisement

Marriott Bonvoy Boundless® Credit Card vs. Wells Fargo Autograph℠ Card

With the Marriott Bonvoy Boundless®, prepare for an exceptional travel experience.

Or, if you’re looking for something different altogether, check out Wells Fargo Autograph℠ Card.

After meeting their prudent spending requirement of $1,500 in three months, enjoy a rewarding 30K ($300) cash back bonus. Endless options await to make your travels as pleasant and cost-efficient as possible.

Marriott Bonvoy Boundless® Credit Card

- Credit Score: 690 to 850 (good to excellent);

- Annual Fee: $95;

- Regular APR: 21.49% – 28.49% variable APR for purchases and balance transfers; 29.99% variable APR for cash advances;

- Welcome Bonus: Limited time offer! Earn 5 Free Night Awards (each night valued up to 50,000 points) after spending $5,000 on purchases in your first 3 months from account opening.

- Rewards: Earn up to 17X total points per $1 spent at thousands of hotels participating in Marriott Bonvoy®;

- Other Rewards: 3x points on every dollar spent on the 1st $6,000 on purchases on grocery, gas stations, and dining each year; earn 1 Elite Night Credit towards Elite Status for every $5,000 you spend.; and earn one free night award (up to 35K points) annually after your account anniversary;

- Terms apply.

Advertisement

Wells Fargo Autograph℠ Card

- Credit Score: 690-850 (good to excellent);

- Annual Fee: $0 annual fee;

- Regular APR: 0% intro APR for the first 12 months for purchases, then 19.24%, 24.24%, or 29.24% variable APR for purchases and balance transfers;

- Welcome bonus: Earn 30K bonus points, which equals $300 cash redemption value, after spending $1,500 in purchases during the first three months of account (limited time offer);

- Rewards: Unlimited 3 points for purchases on restaurants, travel, gas, transit, popular streaming, and phone plans; 1 point on all other purchases.

Are you curious about the Wells Fargo Autograph℠ Card and want to learn more about it? Stay tuned to our application post below. Keep reading!

Wells Fargo Autograph℠ Card application

Learn how to apply for the Wells Fargo Autograph℠ Card. Enjoy cash back reward and welcome bonus! Read on for more!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Learn all the main pros of rewards credit cards

Do you know the pros of credit card rewards? You can take advantage of your credit cards and get a lot of benefits. Learn how to do it.

Keep Reading

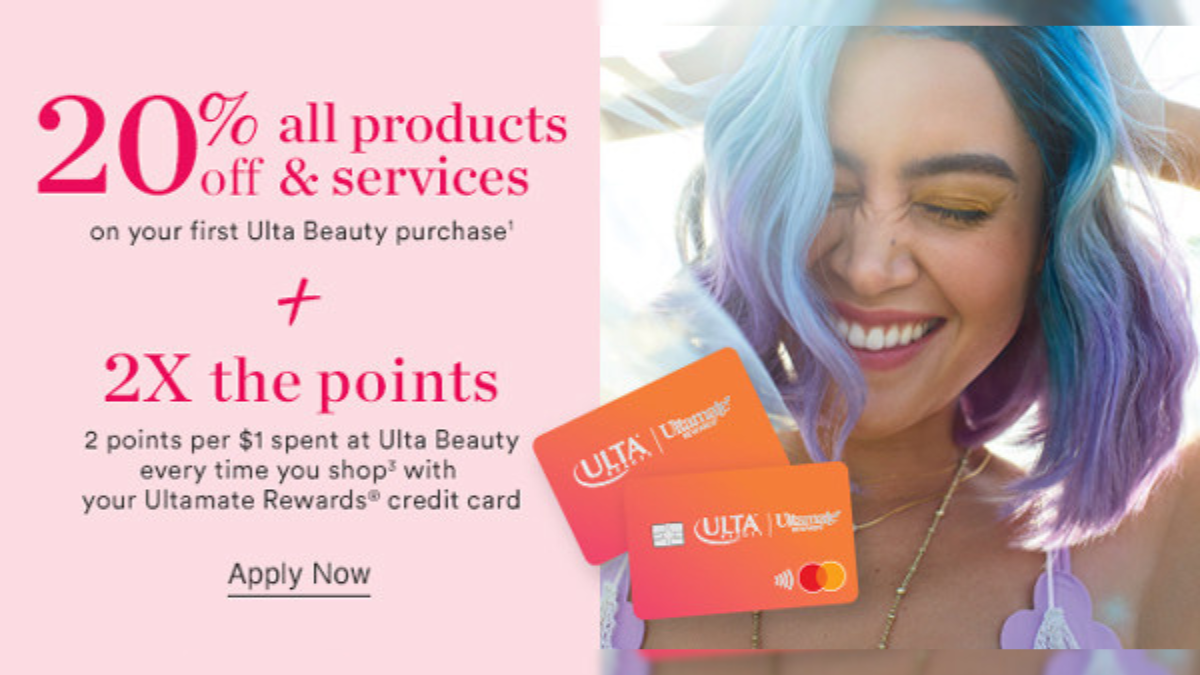

Beauty on a Budget? An Ulta Credit Card Honest Review

Earn 20% off your first beauty purchase at Ulta with the credit card in our review: Ulta Credit Card. Find out other benefits here!

Keep Reading

Another bad week for Tesla’s stock prices

Tesla shares took another big hit this week. Will the latest fall endanger Elon Musk's deal to acquire Twitter? Read on for more!

Keep ReadingYou may also like

Cheap Sun Country Airlines flights: find flights from $39,99!

Get the scoop on what to expect before you book Sun Country Airlines cheap flights. Save a lot on your next trip! Read on and learn how!

Keep Reading

Group One Platinum Card review: No credit check

Check out our Group One Platinum Card review! Enjoy exclusive membership benefits and pay no interest rate with this card! Keep reading!

Keep Reading

Federal Pell Grant: see how to apply

Find out if you're eligible to apply for the Federal Pell Grant. Ensure up to $7,395 to cover educational costs!

Keep Reading