See about an app that offers easy ways to manage your money and track your account!

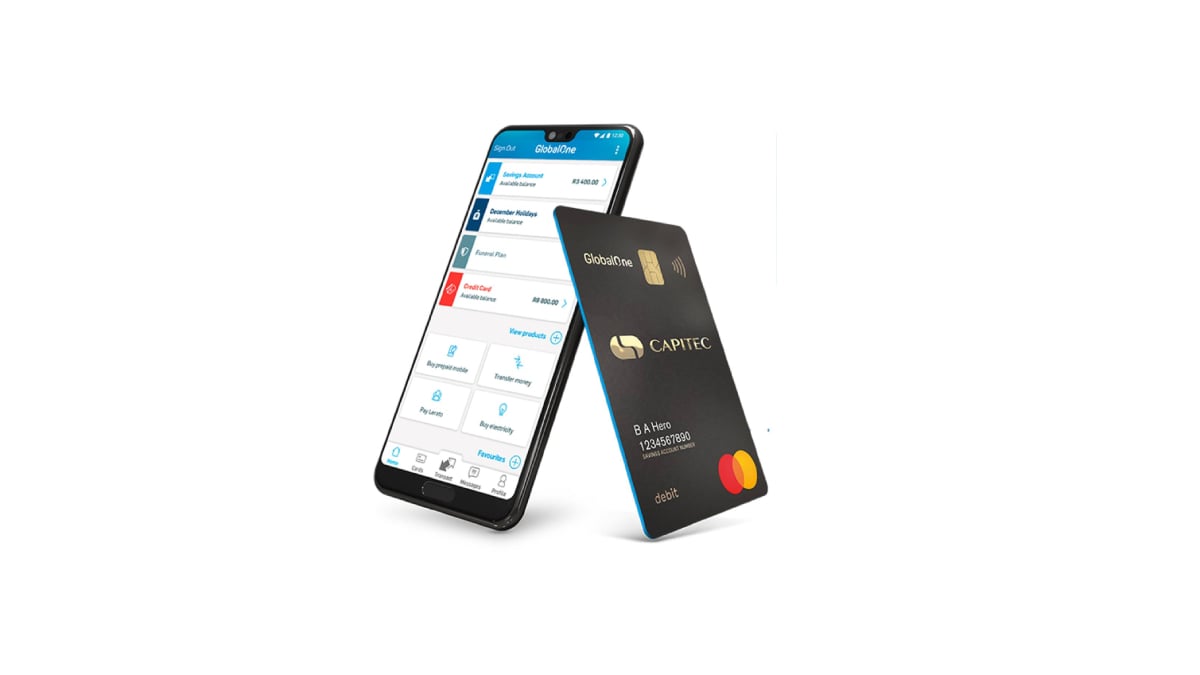

Capitec Bank App: online banking in the back of your hands!

Advertisement

If you’re looking for an easy and convenient way to manage your money, look no further than the Capitec Bank App. This app makes it easy to keep track of your account balance, transactions, and spending patterns. You can also use the app to make payments and transfers. So if you’re looking for a hassle-free way to take care of your finances, be sure to download the Capitec app.

If you’re looking for an easy and convenient way to manage your money, look no further than the Capitec Bank App. This app makes it easy to keep track of your account balance, transactions, and spending patterns. You can also use the app to make payments and transfers. So if you’re looking for a hassle-free way to take care of your finances, be sure to download the Capitec app.

You will remain in the same website

Discover the many benefits you'll have with the Capitec Bank App!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The digital banking landscape has witnessed a transformative player in the form of the Capitec Bank App.

Fusing innovation with user-centric design, this app stands as a testament to Capitec's commitment to redefine everyday banking.

Let's venture into its world, highlighting the compelling advantages it offers and the areas where there's room for improvement.

Strengths and Special Offerings

- User-Friendly Interface: The app's design prioritizes simplicity and clarity, ensuring even the least tech-savvy user can navigate with ease.

- All-in-One Banking: From checking balances to making international transfers, it consolidates all banking needs in one platform.

- Real-time Alerts: Stay informed with instant notifications for all account activity, bolstering security and awareness.

- Budgeting Tools: Empower your financial planning with tools that help track spending, set limits, and visualize your financial growth.

- Remote Account Opening: New to Capitec? Start your banking journey directly from the app without stepping into a branch.

- Quick Access: Biometric features like fingerprint and facial recognition make accessing your account both secure and swift.

Limitations to Consider

- Connectivity Issues: Some users might experience sporadic connectivity issues, especially during peak times.

- Limited Investment Features: While robust for everyday banking, the app might not cater comprehensively to investment enthusiasts.

- Occasional Update Glitches: Post-update phases might be marked with minor bugs or interface changes that could require an adjustment period.

- Mobile-Only Limitations: Some banking features might still require a visit to the branch or access via a computer.

With the Capitec Bank App, the future of convenient banking seems to be unfolding before our eyes.

While it's a stellar representation of modern banking's potential, it also serves as a reminder that even in the digital realm, perfection is a journey, not a destination.

Yet, for many, this app will be the reliable banking companion they've long sought, making fiscal responsibilities less of a chore and more of a streamlined experience.

You can easily activate your Capitec Bank App after you've created a Capitec account. Then, you can download the app on the app store of your preference, such as Google Play or iOS. After that, you can open the app and enter your ID number to prove your identity. You may also need to send some pictures for further identity proof.

Yes! You can easily use the Capitec Bank App to manage your Capitec account, receive transaction alerts, and much more! Also, you can even use your app to manage your finances abroad if you love to travel and use your Capitec account and credit card!

Yes! You can use the Capitec Bank App to send and receive international payments for a small fee per transaction. Moreover, you can even receive and send your money fast and get good foreign exchange rates if you do it often.

Learn how to download the Capitec Bank App

Need help with the Capitec Bank App download? Looking for the perfect app to manage your finances? If so, this quick guide will show you how to download it! Keep reading!

Are you also looking for different types of apps besides the Capitec Bank App? If so, you can learn how to download the Target App!

With this app, you'll be able to get the latest deals and discounts at Target! So, read our post below to learn how to download it!

Learn how to download the Target App

Get your shopping online in easy steps. Downloading the Target app is simple. Just read our step-by-step guide, then you can enjoy same-day delivery!

Trending Topics

The best credit cards in the US for 2022

Learn today what are the best credit cards in the US and start earning rewards and enjoying many benefits and perks in 2022!

Keep Reading

Mission Lane Visa® Credit Card review: Improve your score with a $300 limit

Read on to get a full Mission Lane Visa® Credit Card review! This credit card will help you build credit! Enjoy the initial limit of $300!

Keep Reading

Learn how to download the Capitec Bank App

Find out how to quickly and easily make the Capitec Bank App download. Read on to learn how to enjoy banking online with this app!

Keep ReadingYou may also like

Figure Home Equity Line review: how does it work and is it good?

This Figure Home Equity Line review is the perfect place to start if you're searching. You can qualify for up to $400,000! Keep reading!

Keep Reading

Petal 2 “Cash Back, No Fees” Visa Credit Card application: how does it work?

Do you know how to apply for the new Petal 2 "Cash Back, No Fees" Visa Credit Card? Read our step-by-step guide!

Keep Reading

Merrick Bank Personal Loan review: how does it work and is it good?

In this Merrick Bank Personal Loan review, you will learn about how it works, and the pros and cons of their personal loan products.

Keep Reading