Mortgage

NASB Mortgage review: how does it work and is it good?

Shopping around for a mortgage? Here's a lender that considers nonstandard audiences: NASB Mortgage! Keep reading!

Advertisement

NASB Mortgage: loan options for self-employed and low-income borrowers!

Are you in the market for a mortgage but don’t fit standard requirements? So we’ll discuss a lender that works with various audiences in this NASB Mortgage review.

Learn to apply easily for the NASB Mortgage

Want to know how to apply for the NASB mortgage? Follow this step-by-step guide! Several loan options and repayment flexibility! Read on!

NASB offers many nonstandard loans with higher amounts and more flexible underwriting guidelines than other mortgages. So read on to learn more!

| Credit Score | Conventional loan: 620; Bank Statement Loan: 660; Jumbo or Flex Loans: 690; NASB’s Good Neighborhood Program: 580; |

| Loans Offered | Purchase, Refinance, Jumbo, Fixed, Adjustable, IRA non-recourse loan, Bank statement, Flex loans; |

| Minimum Down Payment | 3%; |

| APR | N/A; |

| Terms | 10 to 30 years. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is the NASB Mortgage?

The National Association of Savings Banks (NASB) offers a range of loan options, such as jumbo loans, self-employed borrower programs, and nonstandard mortgages.

Therefore, our NASB mortgage review starts with its loan options explained.

Statement Loans

Self-employed borrowers can prove their income with bank statements instead of tax returns and pay stubs.

Advertisement

Bridge Loans

This product allows you to buy a house before selling the current one.

Mortgage for Real Estate Investors

With this type of loan, the house is foreclosed if you default payments, but your IRA is protected.

Furthermore, the house used as collateral can’t be a primary residence, only an investment property.

Advertisement

Asset Depletion Loans

Borrowers can use their assets as collateral to qualify for a mortgage.

FLEX Loans

Good for people with nonstandard sources of income, and those who have recently experienced bankruptcy or foreclosure can get the money they need quickly.

Non-warrantable Condo Loans

This mortgage is for people who want to buy a condo that doesn’t fit conventional guidelines.

Low-Income/Moderate Borrowers in Kansas & Missouri

NASB Mortgage’s programs are also designed to help low-income and moderate borrowers purchase homes in Kansas and Missouri.

Portfolio Loans

Good for those who have experienced bankruptcy in the last two years or foreclosure that happened four years ago or more.

Is the NASB Mortgage good?

As you can note in this review, NASB Mortgage is good for borrowers that don’t fit standard requirements. Check out its pros and cons before considering getting it.

Pros

- Many mortgage options;

- Loans for self-employed and nonstandard borrowers;

- Online and in-person services;

- Loans for IRA investors.

Cons

- No home improvements mortgages;

- NASB’s loan programs for low-income borrowers aren’t available nationwide;

- No home equity loans or lines of credit.

Does NASB check credit scores?

Yes, it does. Therefore, your credit score is a primary factor in receiving loan approval from NASB. But the precise score will depend on the kind of home loan you select.

Want to apply for NASB Mortgage? We will help you!

Are you ready to apply for a NASB Mortgage? We can help make it simple! So just check out our post below!

Learn to apply easily for the NASB Mortgage

Want to know how to apply for the NASB mortgage? Follow this step-by-step guide! Several loan options and repayment flexibility! Read on!

Trending Topics

Crafty in Minutes: 6 Incredible Apps to Learn Crochet

Master the art of crocheting with ease! Learn to crochet with the best apps and create unique projects. Start your exciting journey now.

Keep Reading

What are the chances of the US going into another recession?

The recent economic volatility has many people worried about recession fears. But just how high is the risk of another crash?

Keep Reading

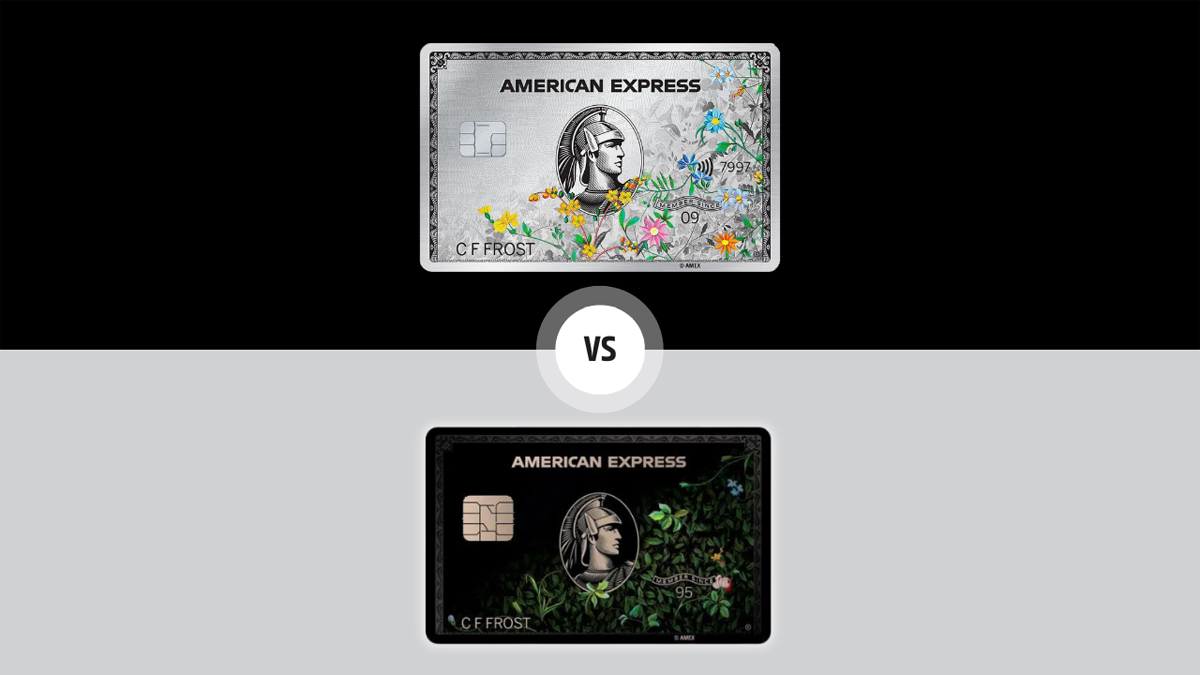

The Centurion® Card or The Platinum Card® from American Express: choose the best!

The Centurion® Card or The Platinum Card® from American Express? We've made a comparison to help you decide which is best.

Keep ReadingYou may also like

Chase Bank Account application: how does it work?

Getting access to a Chase Bank Account is easy. In this article we're going to give you a quick walkthrough of the application process.

Keep Reading

Learn to apply easily for CashUSA.com

Ensure you know how to apply for the CashUSA.com personal loan and get the best rates for your needs. Find out more! Up to $10k!

Keep Reading

Hawaiian Airlines: Follow this guide to track the best prices!

Find out the best ways to buy cheap Hawaiian Airlines flights in this review. Keep reading for more information!

Keep Reading