Reviews

Application for the Destiny Mastercard®: how does it work?

The application process for Destiny Mastercard® is simple. Stay here and read this article to learn about the application.

Advertisement

Destiny Mastercard®: Your chance to improve your score and reclaim your purchasing power!

Have you heard of the Destiny Mastercard®? If you don’t, now is the time to learn more about this credit card.

If you have bad credit, you might think you can’t get a credit card. But there are actually many options out there for people with bad credit.

One option is the Destiny Mastercard®. Here’s how it works: you fill out an application and, if approved, you will be given a credit limit.

You can use your Destiny card just like any other credit card, and as you make on-time payments, your credit score will improve. So if you’re looking for a way to build or rebuild your credit, this may be a good option for you.

Consider applying for it if you need a credit card to improve your score. We’re going to explain everything about the application process. Just keep reading to get one step closer to your new credit card.

Apply online

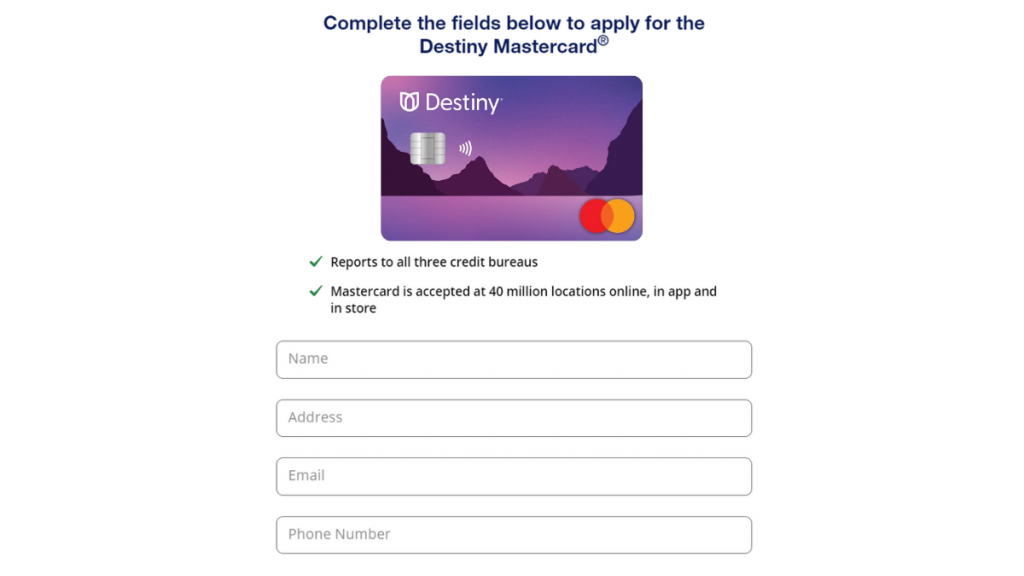

Just like almost everything nowadays, the application for this card can be done online. You just need a computer, internet, and you’re ready to go.

Access the Destiny Website. It is very simple, and you’ll easily find the information you need. The card doesn’t have many features, so there is not much to read about.

You’ll be redirected to a form where basic info is required. All you need to inform is your name, address, contact info, and Social Security Number. Submit the form and you’ll get an answer right away.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Unfortunately, you can’t apply using the app. The only way to apply for a Destiny Mastercard® is through the website.

Destiny Mastercard® vs. First Digital Mastercard®

Let’s put the Destiny Mastercard® side by side with another card for comparison.

| Destiny Mastercard® | First Digital Mastercard® | |

| Credit Score | Poor to Good. | Bad – Fair |

| Annual Fee | See terms. | $75.00 for the first year. After that, $48.00 annually. |

| Regular APR | See terms. | 35.99% |

| Welcome bonus | No welcome bonus is offered. | N/A |

| Rewards | No rewards program. | None |

If you’d rather get the First Digital Mastercard®, this is a good option too. We have content to show you how to apply for it. Stay at The Mad Capitalist to read the First Digital Mastercard® review and apply for it.

How to apply for First Digital Mastercard®

Learn how to apply for the First Digital Mastercard® in just a few easy steps.

Trending Topics

GO2bank™ Secured Visa® Credit Card application: how does it work?

The GO2bank™ Secured Visa® Card is available for rebuilding your credit. Learn about the application requirements and how to apply online!

Keep Reading

Mission Money card application: how does it work?

Download the Mission Lane app, open your account and ask for your Mission Money debit card. You'll pay no fees to use it everywhere.

Keep Reading

The Plum Card® from American Express review

Are you ready for this The Plum Card® from American Express review? Then read on! Pay early and enjoy 1.5% cash back!

Keep ReadingYou may also like

Apply for the First Latitude Select Mastercard® Secured Credit Card

The First Latitude Select Mastercard® Secured Credit Card is a low maintenance option with a modest annual fee. Check out how to apply!

Keep Reading

How to buy cheap Avelo Airlines flights

If you want to buy cheap Avelo Airlines flights, you are in the right place. Read to learn how to find flights from $29! Read on!

Keep Reading

123 Money Loans Review: Payday Loans for All Credit Scores

Explore the pros and cons of 123 Money Loans in our review. From quick cash to potential pitfalls, make an informed decision!

Keep Reading