Credit Cards

Macy’s Credit Card: Quick and Easy Way to Apply

Looking to save money as a smart shopper? Our guide offers quick and easy assistance to apply for a Macy's Credit Card. So read on and learn more!

Advertisement

All information about Macy’s Credit Card has been collected independently by The Mad Capitalist.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Your step-by-step guide to getting your Macy’s credit card

Are you looking to apply for the Macy’s credit card? It’s a fantastic way to enjoy extra perks while shopping at Macy’s.

Applying online is quick and easy; this guide will walk you through the process. Let’s get started!

Apply online

To start your journey towards owning a Macy’s American Express® Card, follow these simple steps:

Advertisement

Step 1: Visit the Amex Website

Head to the American Express (Amex) website to begin your Macy’s credit card application.

You can do this by opening your web browser and typing in the Amex website address.

Step 2: Find the Macy’s Credit Card Page

Once you’re on the Amex website, navigate to the Macy’s credit card page.

You can usually find it in the “Credit Cards” or “Store Credit Cards” section.

Advertisement

Step 3: Hit “Apply Now”

Look for the “Apply Now” button on the Macy’s credit card page. By hitting this button, you will kickstart your application process.

Step 4: Fill Out the Application Form

You’ll be directed to a secure application form. Here, provide the necessary information as requested.

Make sure to double-check your details for accuracy. Once you’ve completed the form, simply submit it.

Step 5: Wait for a Response

After submitting your application, you’ll then receive a response from Macy’s credit card services.

This response will notify you about the status of your application, whether it’s approved or requires further processing.

Be patient as the team reviews your submission.

Apply using the app

While the primary way to apply for the Macy’s credit card is through the website, you can also use your smartphone to access the website and follow the same steps.

Indeed, it’s convenient and just as straightforward.

Macy’s Credit Card vs. Torrid Credit Card

When deciding between the Macy’s Credit Card and the Torrid Credit Card, it’s important to consider your shopping habits and credit card preferences.

Macy’s provides discounts, rewards, and free shipping, as well as birthday surprises.

Conversely, Torrid is geared towards plus-size fashion lovers and offers rewards, early access to sales, and exclusive event invitations.

Check out their main features below.

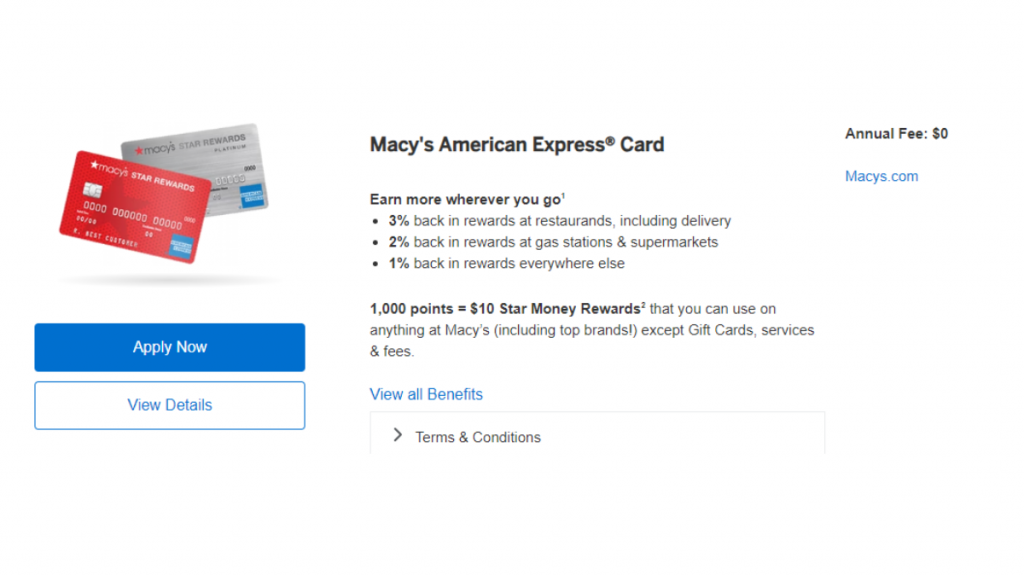

Macy’s Credit Card

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Purchase APR: 31.99% (Variable);

- Cash Advance APR: 31.99% (Variable);

- Welcome Bonus: 20% off on your $100 on purchases in the first two days of account;

- Rewards: 3 % back in rewards at restaurants (delivery included), 2% at gas stations and supermarkets, and 1% in everything else.

Torrid Credit Card

- Credit Score: 630 or higher;

- Annual Fee: $0;

- Purchase PR: 25,99% Variable;

- Cash Advance APR: N/A;

- Welcome Bonus: off your first purchase after opening and using the Torrid Credit Card online, plus $15 off $50 purchase once your Torrid card arrives;

- Rewards: 5% off on all purchases using the card.

Apply for the Torrid Credit Card now. Find out the instructions to make your application below.

Up to 40% off Now: How to Apply for Torrid Card

Are you a Torrid lover? Learn to apply for the Torrid Credit Card now and score a 5% discount on all your purchases. Keep reading!

Trending Topics

First Access Visa® Card review

Should you give this excellent credit card a try? Find out in the First Access Visa® Card review. Keep reading!

Keep Reading

OpenSky® Secured Visa® Credit Card review

Learn about the OpenSky® Secured Visa® Credit Card in this review: start a path to a better financial future and build your credit history.

Keep Reading

Application for the Assent Platinum Secured credit card: how does it work?

Learn how to apply for Assent Platinum Secured, a card with no credit history required and that helps you build your credit score!

Keep ReadingYou may also like

FIT™ Platinum Mastercard® credit card review: easy to get, efficient to build credit

FIT™ Platinum Mastercard® credit card is your chance to get a $400 credit limit even if you don't have a strong score. Read our review!

Keep Reading

Choose the best card to build your credit score: improve your finances!

Here's a complete guide on how to choose the best card to build your credit score. Keep reading to find out more!

Keep Reading

Apply for Hawaiian Airlines® World Elite Mastercard® easily

Apply for the Hawaiian Airlines® World Elite Mastercard® following this step-by-step. Earn 60K bonus miles in no time! Read on!

Keep Reading