Loans

Tesco Bank Personal Loan Review: Get Funds Within 24 Hours

Need a personal loan? Tesco Bank provides loans up to £35,000 with fixed payments and exclusive Clubcard discounts. Discover how to apply!

Advertisement

Tesco Bank Personal Loan – Benefit from fixed payments, Clubcard discounts, and fast fund transfers

Tesco Bank Personal Loan provides a simple and transparent way to finance your needs. Whether you want to improve your home, consolidate debts, or make a major purchase, Tesco Bank offers competitive rates and flexible terms.

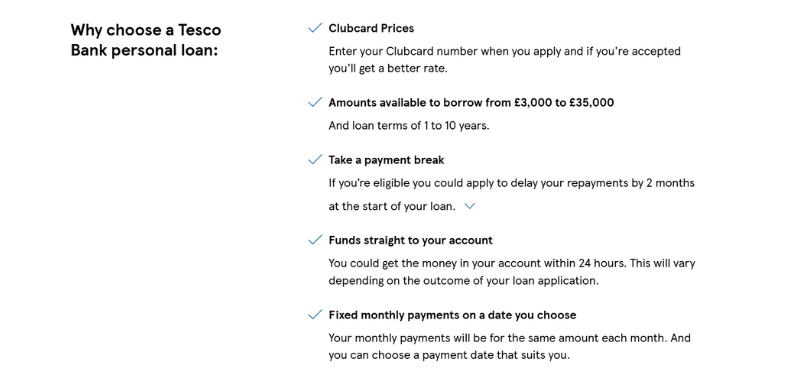

If you’re a Tesco Clubcard holder, you may be eligible for exclusive Clubcard Prices, which can lower your loan’s interest rate. Additionally, Tesco Bank offers an easy online application process with fast access to funds.

Before applying, it’s essential to check your eligibility using the Tesco Personal Loan Calculator to get an estimate of your monthly repayments. Read on to learn more about loan features, pros and cons, and the application process.

- APR: Representative 6.0% APR for loans from £7,500 to £25,000 (1-5 years). Other rates may apply.

- Loan Purpose: Home improvements, debt consolidation, car purchase, weddings, holidays, and more.

- Loan Amounts: £3,000 to £35,000.

- Credit Needed: Subject to credit check and financial assessment.

- Late Fee: £12 for late or missed payments.

- Early Payoff Penalty: Two-month interest charge applies.

Information collected from the official Tesco Bank website.

You will be redirected to another website

Advertisement

Tesco Bank Personal Loan Overview

Tesco Bank provides personal loans with fixed interest rates, ensuring that your monthly payments stay consistent for the entire duration of the loan. This predictability makes budgeting easier.

Loan terms range from 1 to 10 years, allowing flexibility depending on the amount you borrow and your financial goals. Clubcard members benefit from lower interest rates, making borrowing more affordable.

Funds are usually transferred within 24 hours after approval; for eligible customers, a two-month payment break is available at the beginning of the loan, offering financial flexibility.

Additionally, Tesco Bank allows overpayments with no extra fees, enabling you to repay your loan faster and reduce overall interest costs.

Tesco Bank Personal Loan: Pros and Cons

When considering a Tesco Bank Personal Loan, it’s essential to weigh the benefits and drawbacks to determine if it meets your financial needs. Below is a detailed breakdown of the pros and cons.

Advertisement

Pros

- Exclusive Clubcard Discounts – If you’re a Tesco Clubcard member, you may receive a lower APR compared to non-members. This can lead to significant savings on interest payments over the life of the loan.

- Fixed Monthly Repayments – Tesco Bank personal loans come with a fixed interest rate, ensuring that your monthly payment amount remains the same throughout the loan term. This makes budgeting easier and eliminates surprises.

- Quick Fund Transfer – Once approved, funds can be deposited into your account within 24 hours. In some cases, eligible customers may receive the funds within just 2 hours, depending on processing times.

- Flexible Loan Terms – Tesco Bank offers loan terms ranging from 1 to 10 years, allowing borrowers to choose a repayment period that best suits their financial situation and goals.

- Penalty-Free Extra Payments: Borrowers can make additional repayments whenever they choose without incurring any fees. This feature allows you to pay off your loan faster, reducing the total interest you owe.

- Payment Deferral – Eligible borrowers can postpone their first two repayments, benefiting from a two-month break at the start of the loan.

- Borrow More if Needed – Once you’ve made 8 consecutive monthly payments, you may be eligible to apply for additional borrowing on top of your existing loan.

- Online Eligibility Checker – Tesco Bank offers a soft credit check tool that allows you to see if you’re likely to be approved before applying. This does not affect your credit score.

- Flexible Payment Date – You can choose a repayment date that fits your schedule, ensuring that payments align with your income and budgeting needs.

- Unsecured Loan – Tesco Bank loans are not secured against your home, car, or other assets, reducing the risk of losing property if you struggle to make repayments.

Cons

- Early Repayment Fee – If you choose to settle the loan early, you will be charged a two-month interest penalty. While this may still result in savings, it adds an extra cost for early closure.

- Credit Check Required – To apply, Tesco Bank conducts a hard credit check, which may affect your credit score. Applicants with poor credit may struggle to get approved or may receive higher APR rates.

- Late Payment Fees – If you miss a repayment, Tesco Bank charges a £12 late fee. If you continue to miss payments, additional charges and credit score damage may occur.

- Limited Information on Fees – While Tesco Bank provides details on APR and repayment terms, origination fees and specific penalty charges are not clearly stated on the website.

- Clubcard Requirement for Best Rates – The lowest APR is only available to Tesco Clubcard members. Non-members may receive a higher APR, reducing the overall cost-effectiveness of the loan.

- Interest Charged During Payment Break – If you opt for the two-month payment break, interest will still accrue during this period. This means you’ll end up paying slightly more over the life of the loan.

- Maximum APR Can Be High – While Tesco Bank advertises a representative 6.0% APR, applicants with lower credit scores may receive an APR as high as 34.5%, making borrowing expensive.

- Limited Loan Use Restrictions – Certain loan purposes may have shorter maximum repayment terms. The website does not specify which purposes may be subject to restrictions.

- Loan Amount Limits – Tesco Bank personal loans start at £3,000, meaning borrowers looking for smaller amounts may need to consider alternative lenders with lower minimum borrowing limits.

- No In-Person Branch Support – Tesco Bank operates entirely online and via phone, so customers who prefer face-to-face banking may find it inconvenient compared to traditional banks.

By reviewing these detailed pros and cons, you can make an informed decision on whether a Tesco Bank Personal Loan aligns with your financial needs and repayment capabilities.

Advertisement

Minimum Credit Score

Tesco Bank does not specify a minimum credit score for loan approval. However, your eligibility depends on a credit check and financial assessment.

Having a solid credit record improves your chances of approval and can help you secure more favorable interest rates. If you’re unsure, you can use Tesco’s eligibility checker without affecting your credit score.

If you have a lower credit score, improving your financial situation before applying may help secure better loan terms.

Want to Apply for the Tesco Bank Personal Loan? We Will Help You!

Applying for a Tesco Bank Personal Loan is straightforward, with multiple options available.

Check Out the Ways to Apply

- Online: Apply via the Tesco Bank website and receive an instant decision.

- Phone: Contact Tesco Bank customer service for assistance with your application.

Applying Instructions for Tesco Bank Personal Loan

- Check your eligibility: Use the Tesco Personal Loan Calculator to estimate your repayments and check eligibility.

- Gather required information: Have details about your income, employment, and finances ready.

- Complete the application: Apply online or by phone, providing necessary details.

- Submit and wait for a decision: Tesco Bank assesses your application and informs you of the outcome.

- Receive funds: If approved, funds are typically transferred within 24 hours.

Tesco Bank Personal Loan vs. First Direct Personal Loan

When choosing a personal loan, comparing different options is essential to ensure you’re getting the best deal for your financial situation.

So, when deciding between a Tesco Bank Personal Loan and a First Direct Personal Loan, it’s important to compare their key features. Each lender has unique advantages, and the right choice depends on your financial needs and personal circumstances.

Tesco Bank offers loans from £3,000 to £35,000, with repayment terms ranging from 1 to 10 years. Clubcard members benefit from lower interest rates, and funds can be transferred within 24 hours.

First Direct, on the other hand, provides loans starting at £1,000 up to £50,000, with terms from 1 to 8 years. The application process is fast, and approved funds are immediately deposited into your First Direct account. However, First Direct loans are not available to new customers — only existing account holders can apply.

Let’s take a look at a comparison table to see the differences more clearly:

| Feature | Tesco Bank Personal Loan | First Direct Personal Loan |

|---|---|---|

| Loan Amount | £3,000 – £35,000 | £1,000 – £50,000 |

| Loan Term | 1 to 10 years | 1 to 8 years |

| Representative APR | 6.0% (for Clubcard holders) | 5.9% (for £10,000-£30,000) |

| Early Repayment Fee | 2-month interest charge | 28 days’ interest for <12 months; 1 month + 28 days for >12 months |

| Overpayment Penalty | None | None |

| Eligibility | Open to UK residents 18+ | Must have a First Direct current account |

| Approval Speed | Decision within minutes, funds in 24 hours | Instant decision, funds immediately transferred |

| Payment Break Option | Yes (2-month break available) | No payment holidays offered |

If you prioritize flexible loan terms, fast fund transfers, and Clubcard discounts, a Tesco Bank Personal Loan may be the better choice. However, if you are an existing First Direct customer and want lower APR for larger loans, the First Direct Personal Loan could be a suitable option.

For more details on First Direct loans, check out our full guide!

First Direct Personal Loan

Looking for a reliable personal loan? First Direct offers up to £50,000 with fixed repayments and fast approval. Learn how to apply today!

The content on this page is current as of January 30, 2025, though some promotions may no longer be valid.

Trending Topics

Barclays Personal Loans Review: Apply Online in Just 10 Minutes!

Get the best rates, quick approvals, and tailored financing for your personal needs with Barclays Personal Loans.

Keep Reading

TSB Personal Loan Review: Flexible Loans Up to £25,000

TSB Personal Loan offers competitive rates from 5.9% APR. Learn about loan amounts, eligibility, and how to apply!

Keep Reading

M&S Bank Personal Loan Review: Borrow Up to £25,000 with Fixed Rates

Need funds? The M&S Bank Personal Loan provides fixed repayments and competitive rates for UK residents. See how to apply!

Keep ReadingYou may also like

Loans 2 Go Personal Loans Review: Get Up to £2,000 Even with Poor Credit

Looking for fast financing? Loans 2 Go UK provides same-day payouts, flexible repayments, and loans for all credit types.

Keep Reading

Santander Debt Consolidation Loan Review: Borrow Up to £25,000 with Fixed Rates

Santander Debt Consolidation Loan helps reduce financial stress by consolidating multiple debts into one structured repayment plan!

Keep Reading

First Direct Personal Loan Review: Quick Approval for Loans Up to £50,000!

Get a First Direct Personal Loan with competitive 5.9% APR. Apply online and receive funds instantly! Learn more.

Keep Reading