Debit Cards

WWE Netspend® Prepaid Mastercard®: apply today

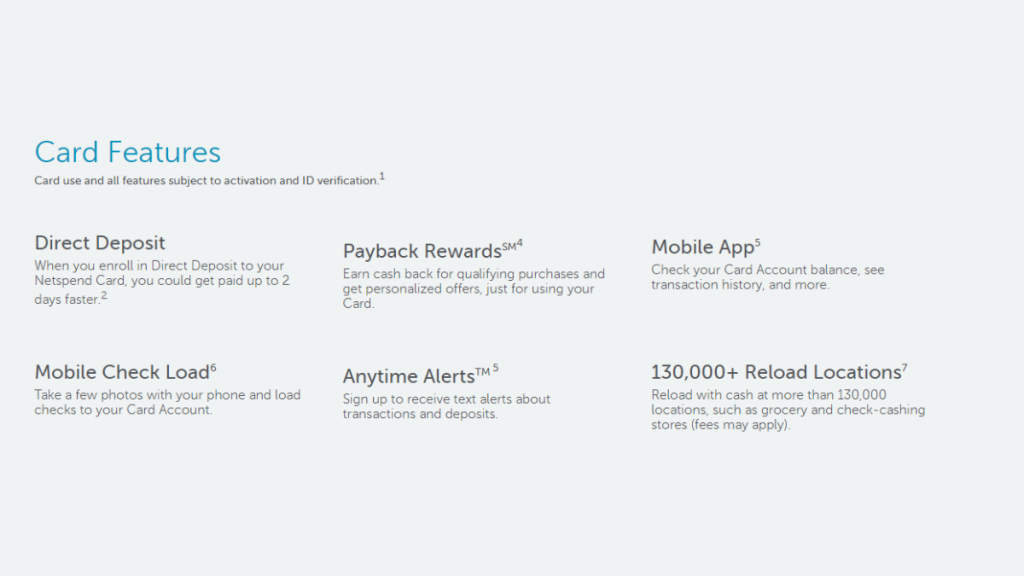

Apply for the WWE Netspend® Prepaid Mastercard® and simplify your finances - 0% APR and amazing benefits! Read on and learn more!

Advertisement

Receive your new card within 7-10 business days after the application

Are you looking for a prepaid card that can help you easily manage your finances? Then apply for the WWE Netspend® Prepaid Mastercard® today!

This card is a great choice with its user-friendly features and flexible options. Then keep reading and learn more!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

One of the easiest ways to apply for the WWE Netspend® Prepaid Mastercard® is to do so online. Simply visit the Netspend® website and click the “Get A Card” button.

You will be asked to provide basic personal information, such as your name, address, and social security number.

Once you have completed the application, you can expect to receive your new card within 7-10 business days.

Applying online is a great option for those who want to apply at their convenience, without the need to leave their home or office.

Finally, the process is simple, and you can track the status of your application online at any time.

Apply using the app

Another convenient way to apply for the WWE Netspend® Prepaid Mastercard® is the Netspend® mobile app.

Simply download the app from the App Store or Google Play and follow the on-screen instructions to apply for your card.

The app offers a user-friendly interface, making the application process quick and easy.

With the Netspend® mobile app, you can check your balance, view your transaction history, and find the nearest reload location.

This makes it a great option for those who want to manage their finances on the go.

Advertisement

WWE Netspend® Prepaid Mastercard® vs. Western Union® Netspend® Prepaid Mastercard®

If you are considering the WWE Netspend® Prepaid Mastercard®, you may also want to compare it to the Western Union® Netspend® Prepaid Mastercard®.

While both cards offer many of the same features, there are some key differences to remember.

Check out the comparison and decide which is best for you!

WWE Netspend® Prepaid Mastercard®

- Credit Score: All types of credit scores are accepted;

- AnnFee Fee: Up to $9.95 per month, depending on the plan you choose;

- Purchase APR: 0%;

- Cash Advance APR: 0%;

- Welcome Bonus: Not disclosed;

- Rewards: Enroll in the Payback Rewards program and get personalized offers.

Advertisement

Western Union® Netspend® Prepaid Mastercard®

- Credit Score: All types of credit scores are accepted;

- AnnFee Fee: $0 up to $9.95 monthly, depending on the purchase plan you choose;

- Purchase APR: None;

- Cash Advance APR: None;

- WelcBonusonus: $20 credit when you refer a friend who activates their new card and loads at least $40;

- Rewards: Not disclosed.

Overall, the Western Union® Netspend® Prepaid Mastercard® is a great alternative for anyone looking for a flexible and user-friendly prepaid card.

So why wait? Learn how to apply below.

Western Union® Netspend® Prepaid application

Simplify your financial management with the Western Union® Netspend® Prepaid Mastercard®. Apply now and enjoy the conveniences.

Trending Topics

Application for the Luxury Titanium card: how does it work?

The Luxury Titanium credit card has premium benefits and will give you reward points in every purchase. Learn how to get yours.

Keep Reading

Wells Fargo Reflect® Card: La tarjeta de crédito de bajo APR que estabas buscando

Echa un vistazo al Wells Fargo Reflect® Card para ver si cumple con tus necesidades financieras. Sin tarifa anual y 0% de APR introductorio.

Keep Reading

GO2bank™ Secured Visa® Credit Card application: how does it work?

The GO2bank™ Secured Visa® Card is available for rebuilding your credit. Learn about the application requirements and how to apply online!

Keep ReadingYou may also like

Apply for the Ink Business Cash® Credit Card: Maximized rewards

Discover step-by-step how to apply for the Ink Business Cash® Credit Card online and get rewarded for your business expenses. Read on!

Keep Reading

Delta SkyMiles® Gold Business American Express Card review

Here is the Delta SkyMiles® Gold Business American Express Card review to help you understand how it works. Keep reading!

Keep Reading

What Is a FICO Score? Understand the Basics

Demystifying your credit: What is the FICO Score? Learn how to improve it and take charge of your finances with our guide!

Keep Reading